1. Crypto Market Last Week

Last week, Bitcoin unexpectedly experienced a significant correction down to the level of 91,300, causing the largest liquidation in the cryptocurrency market, with the amount liquidated reaching up to $2.75 billion. Experts even suggest that this figure could rise to $10 billion, surpassing both the LUNA and FTX events. Following this, Bitcoin started to recover, quickly returning to the price point of 102,400, but has since adjusted back down to 96,000. While Bitcoin has recovered, most altcoins have not benefited, as dominance continues to rise and most altcoins are still probing for a bottom.

CZ, the former CEO of Binance, also tweeted for the first time about memecoins on X last week, even providing a purchase link for his followers. At the time of his post, the market cap of the memecoin TST was only $500,000, but just two days later, TST was listed on Binance with a market cap exceeding $500 million (a 1000x increase). This has sparked mixed opinions within the community.

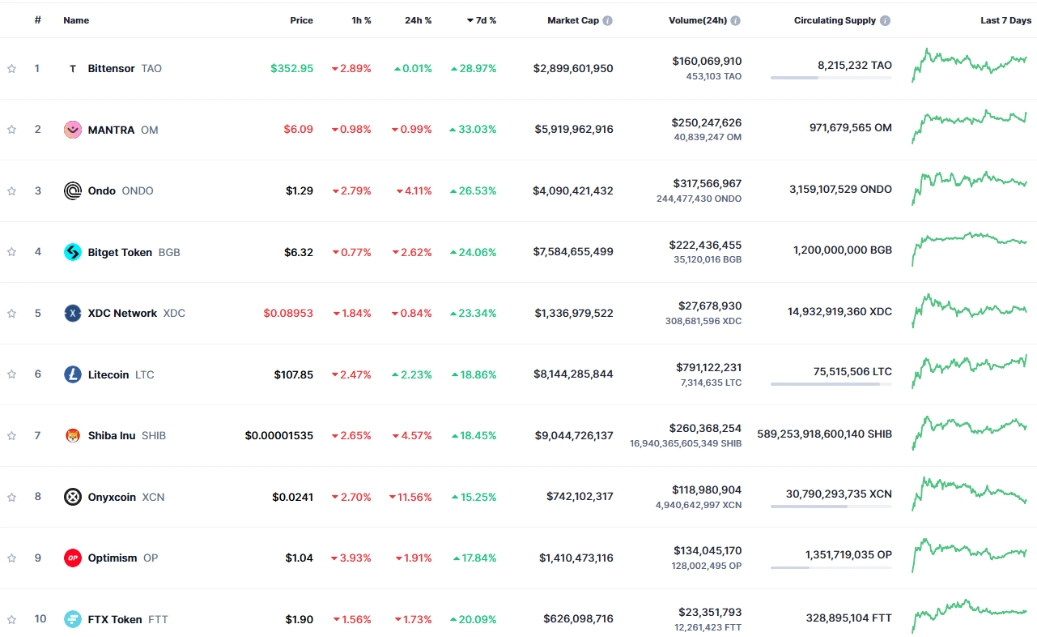

Top 10 Gainers of the Week

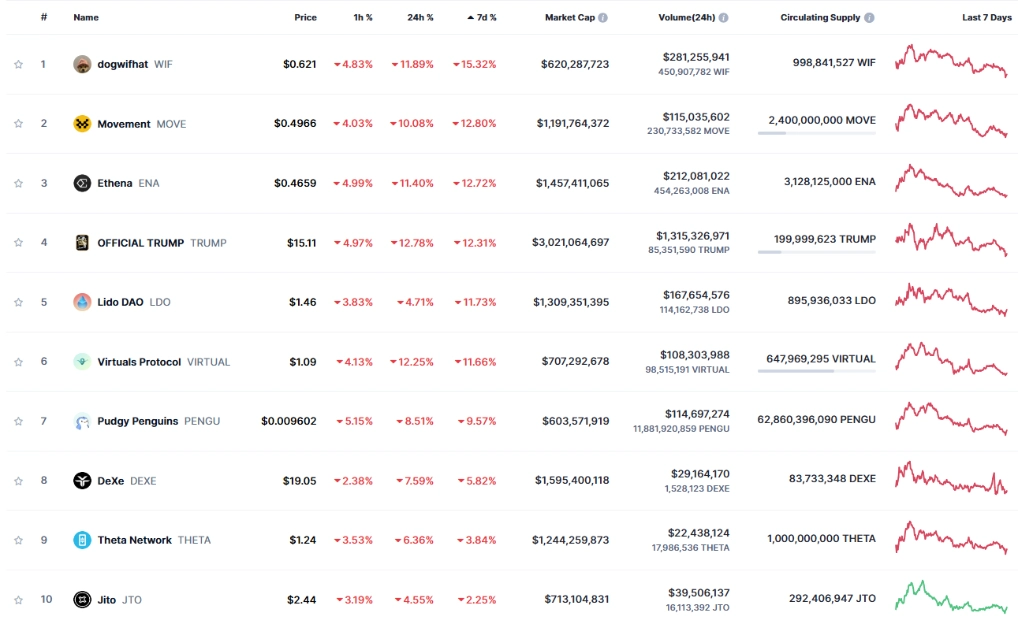

Top 10 Losers of the Week

Key Highlights

- The First U.S. State to Pass a Bitcoin Reserve Law

- OpenAI’s ChatGPT Unveils a Major Upgrade

- Vitalik Buterin Unveils Ethereum’s Major Upgrade

- China Imposes 15% Tariff on Imports from the U.S., Bitcoin Responds Immediately

- Binance Announces Listing of Berachain (BERA) on February 6, 2025

- Google to Spend $75 Billion on AI This Year

- FTX Announces Debt Repayment Starting February 18

- The U.S. Bans AI Technology Imports and Exports, Including DeepSeek

2. Crypto Market This Week

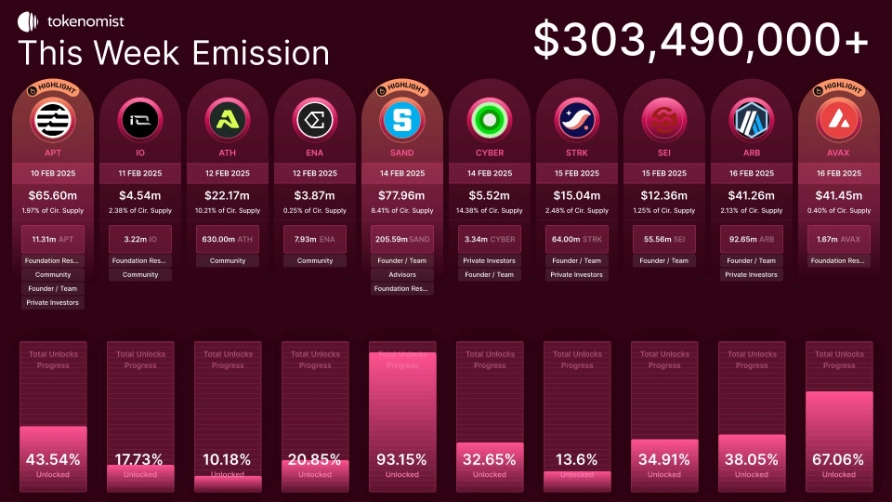

Token Unlock Schedule

This week, the market will continue to experience major token unlock events, with a total value of approximately $303.49 million, including:

- $SAND (8.41%) – $77.96M

- $APT (1.97%) – $65.60M

- $AVAX (0.40%) – $41.45M

- $ARB (2.13%) – $41.26M

- $ATH (10.21%) – $22.17M

- $STRK (2.48%) – $15.04M

- $SEI (1.25%) – $12.36M

Macroeconomic News

Additionally, several key macroeconomic reports this week could significantly impact the market:

- Wednesday (Feb 12) at 13:30 – January CPI news released.

- Thursday (Feb 13) at 13:30 – Initial unemployment claims and PPI.

Importantly, this week there will be information regarding taxation from Trump and the U.S., so the market is expected to be extremely volatile.