The year 2024 marked a historic milestone for Bitcoin as it achieved remarkable breakthroughs. Beyond reaching an all-time high (ATH), both individual investors online and major financial institutions expressed great optimism about Bitcoin’s potential for robust growth in 2025.

Bitcoin’s price surged by 210% since November 1, 2023, reaching an all-time high of over $108,000 on December 16, 2024. When compared to the performance of U.S. stocks during the same period, Bitcoin delivered significantly higher returns.

While the S&P 500, the benchmark for the U.S. stock market, gained 45%, and the tech-heavy Nasdaq Composite increased by 55%, Bitcoin outperformed by a wide margin, according to data from Yahoo Finance.

What makes this achievement even more extraordinary is that 2024 was already a stellar year for the stock market, yet Bitcoin’s performance stood out. Analysts and traditional financial institutions are now anticipating a similar explosion in the cryptocurrency market in 2025. Here are five “engines” driving Bitcoin toward a new ATH in 2025:

1. A Sharp Decline in Exchange Balances

According to the basic law of supply and demand, the decreasing availability of Bitcoin on exchanges is an extremely bullish signal for BTC’s value in 2025.

Bitcoin reserves on exchanges have plummeted to record lows not seen since February 2018, according to data from Coinglass, while BTC’s price has surged near historical highs. This trend not only reduces the supply available for selling but also indicates increasing long-term confidence among investors.

2. Corporations and Governments Adding Bitcoin to Their Reserves

The U.S. government’s involvement in the Bitcoin race is a clear sign of long-term bullish momentum. The Trump administration plans to retain its strategic reserve of 198,000 BTC rather than auctioning it off as in the past. Senator Cynthia Lummis has even proposed increasing reserves to 1 million BTC, recognizing Bitcoin as a transformative force for global finance.

Additionally, major corporations like MetaPlanet, MicroStrategy, and Semler Scientific are aggressively accumulating Bitcoin to strengthen their financial positions. Rising demand from Bitcoin ETFs on Wall Street further fuels the market’s growth.

Related: Will 2025 Be a Boom Year for Bitcoin DeFi?

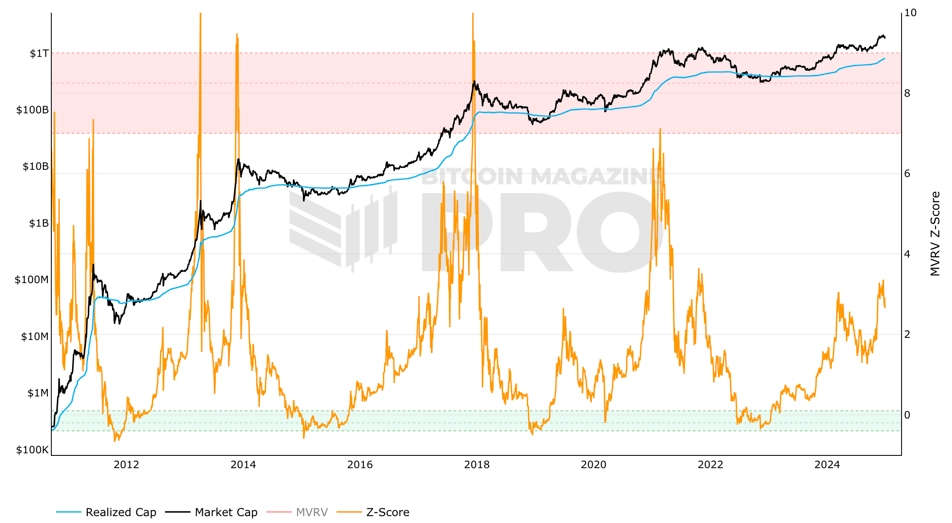

3. MVRV Z-Score: A Strong Bullish Indicator

The MVRV Z-Score, a key metric for assessing Bitcoin’s long-term valuation, signals substantial growth potential. On January 1, the ratio was below 3, far from the 7 mark that has historically indicated market peaks in previous cycles. This suggests that Bitcoin’s price could still double in the current cycle.

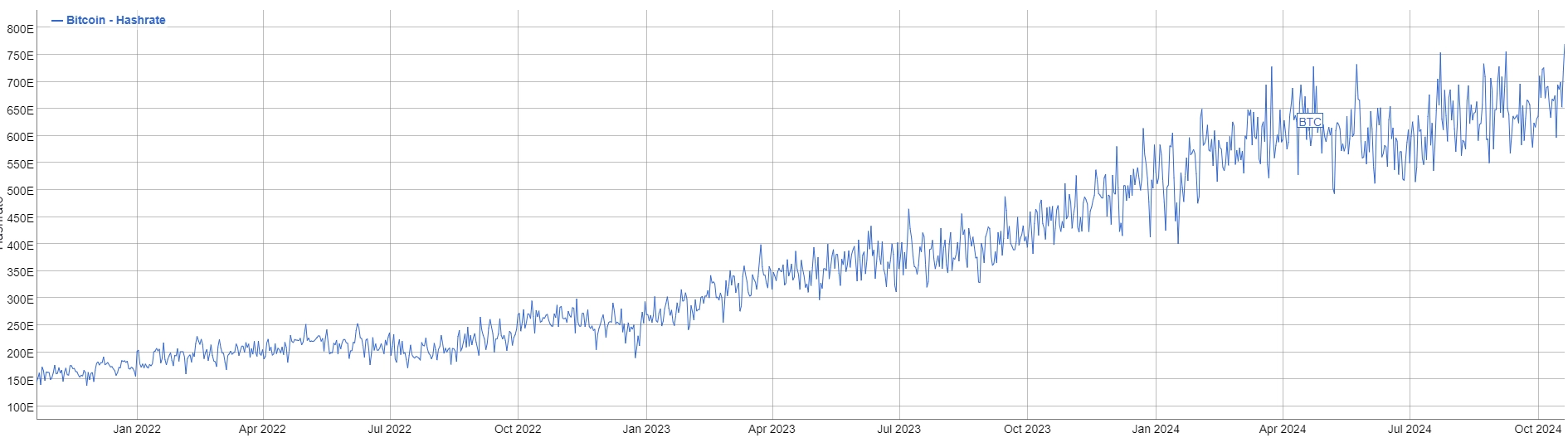

4. Hashrate Reaches New All-Time High

Bitcoin’s hashrate—a measure of the network’s computational power—hit a new record in December 2024.

When hashrate rises, it is a positive signal for Bitcoin’s price. This is because miners must invest significant amounts of energy and computational resources—resources that could be used elsewhere—to operate Bitcoin’s core software. They do so with the expectation of receiving rewards from the blockchain, paid in newly minted Bitcoin.

Thus, a rising hashrate reflects strong confidence in Bitcoin’s potential price appreciation, especially from the most knowledgeable stakeholders within the ecosystem.

5. Interest Rate Cuts and U.S. Federal Budget Deficit

The Trump administration’s plans for increased public spending are expected to significantly widen the federal budget deficit, driving inflation higher. This macroeconomic backdrop creates a powerful tailwind for hedge assets like Bitcoin, which are expected to benefit greatly from such trends.

Growing demand from major financial institutions, including Bitcoin ETFs and investment banks, adds further momentum to the market. With Wall Street’s increasing interest, Bitcoin is poised to remain at the center of investment flows.