The cryptocurrency market witnessed a pronounced divergence in June 2025, as centralized exchanges (CEX) experienced a significant decline, while decentralized exchanges (DEX) continued their impressive growth, according to data from The Block.

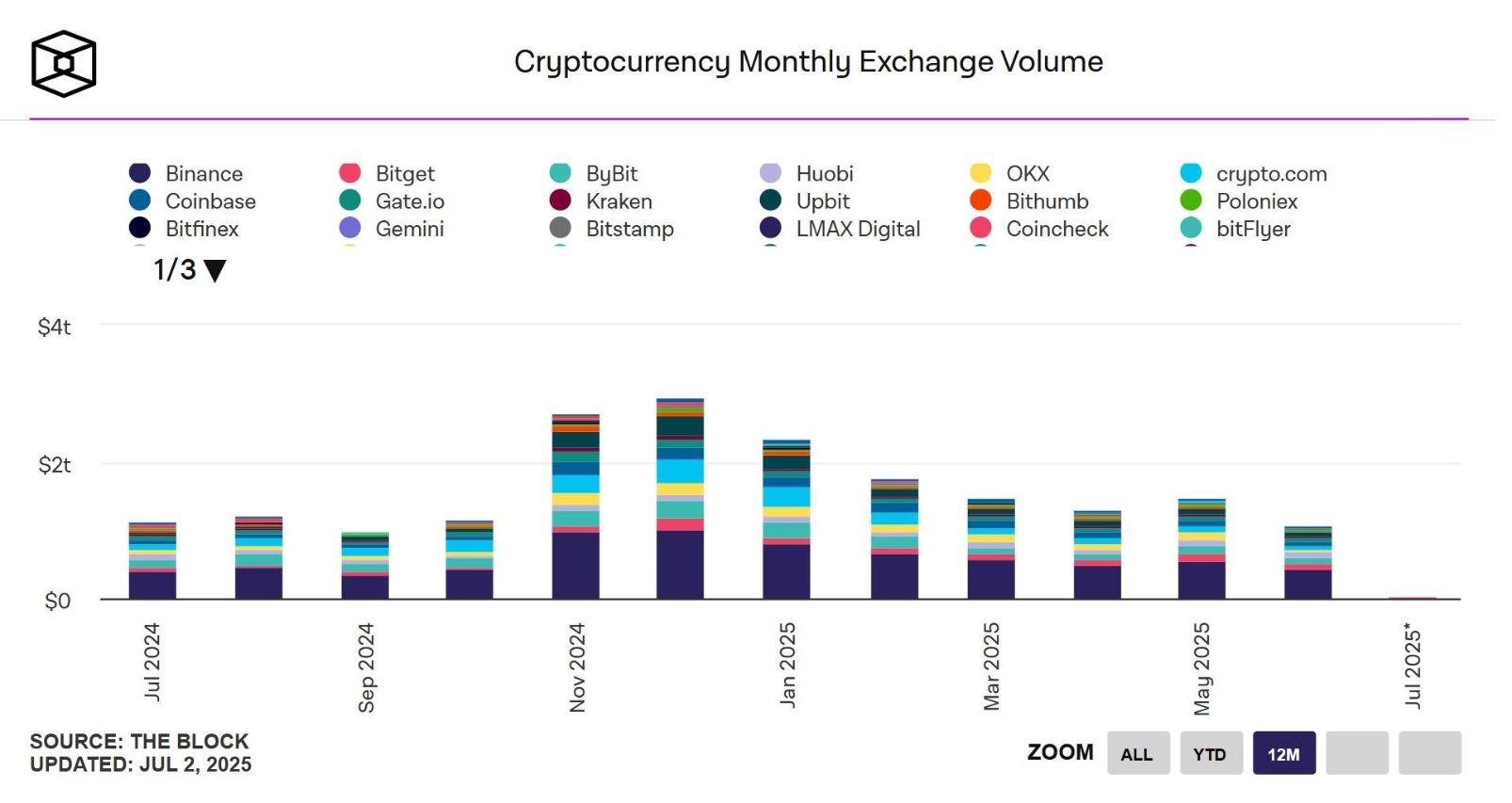

Spot trading volume on CEX platforms, such as Binance and OKX, reached only $1.07 trillion in June 2025, marking a sharp 27% drop from $1.47 trillion the previous month. This is the lowest level since September 2024 and represents a staggering 63.6% decrease from the peak of $2.94 trillion in December 2024. This decline indicates investor caution on centralized platforms, possibly due to market volatility or regulatory factors.

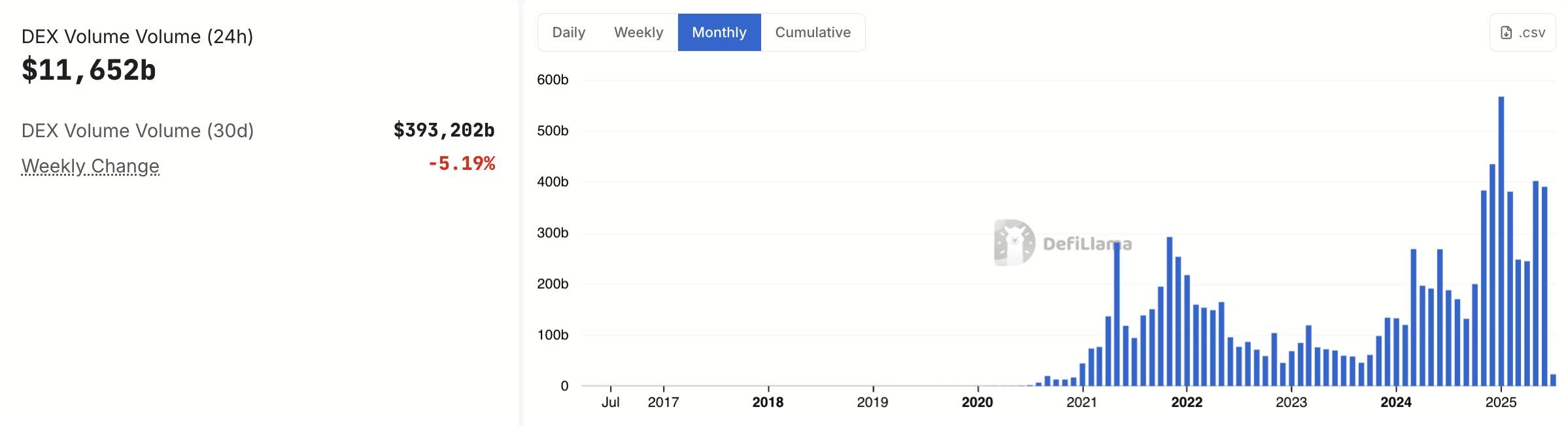

In contrast, DEX platforms like PancakeSwap and Aerodrome have become the focal point of attention. Spot trading volume on DEX reached $390 billion in June 2025, marking the second consecutive month of growth. This figure not only reflects a clear recovery after the early year’s downturn but also affirms the growing appeal of decentralized platforms, where users can trade directly without intermediaries.

Related: Can Altcoins Grow in July?

The growth of DEX has pushed the spot trading ratio of DEX to CEX to a record high of 29%, meaning that for every $1 billion traded on CEX, up to $290 million was conducted on DEX.

Furthermore, the futures trading ratio on DEX compared to CEX also hit an all-time high of 8%, reflecting the trend of investors shifting towards decentralized platforms. This demonstrates an increasing trust in the transparency and self-management capabilities of DEX.

The divergence between CEX and DEX in June 2025 not only reflects a change in investor behavior but also serves as evidence of the potential of decentralized platforms to shape the future of the cryptocurrency market. While CEX still dominate in scale, the growth momentum of DEX indicates an irreversible trend: users are seeking greater flexibility, transparency, and control in their financial transactions.