Cetus, a decentralized trading platform and liquidity infrastructure provider (Dex) on Sui, has announced that users affected by the $223 million attack on May 22 may be fully reimbursed, depending on the outcome of an upcoming community vote.

“Thanks to our cash reserves and existing token holdings, we are fully capable of compensating all stolen assets if the locked funds are restored through the community vote,”

“This reimbursement includes a significant loan from the Sui Fund, opening up a 100% recovery opportunity for all affected users,” Cetus shared on platform X today.

Cetus emphasized that the outcome of the vote will be crucial in ensuring full reimbursement.

“We call for enthusiastic support from the Sui community to pass the proposal to restore assets. We acknowledge this is a special request arising from our own mistakes, but it is the right action, especially for those who have suffered losses,” a representative from Cetus stated.

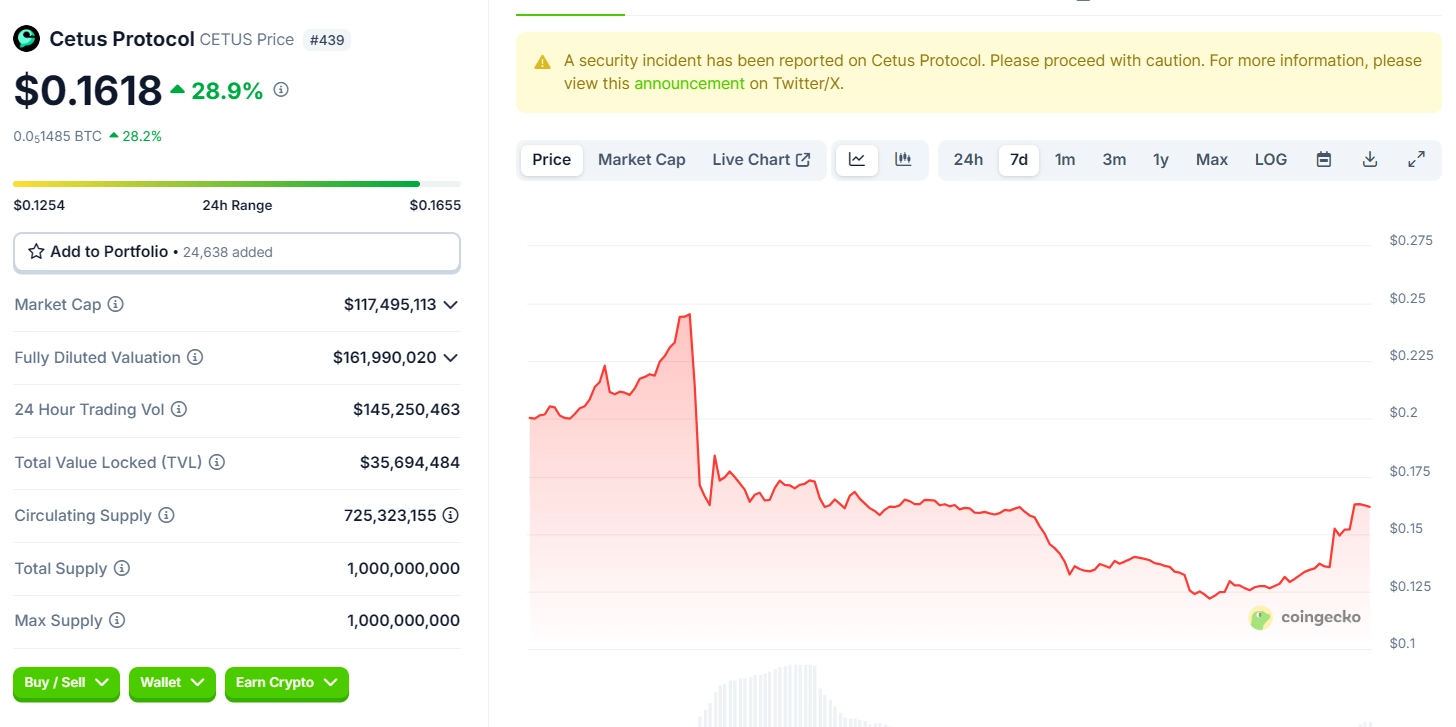

Regardless of the voting outcome, Cetus is committed to immediately starting the recovery process and asserting its determination to “fully rectify the consequences.” Following this announcement, the CETUS token price surged by 30%.

Related: Overview of the Cetus Protocol Hack

The attack on May 22 sent shockwaves through the Sui ecosystem, causing many token prices to plummet, some even dropping by up to 90%. The CETUS token of this protocol alone lost 50% of its value. The cause was identified as a vulnerability in the smart contract of the CLMM (Concentrated Liquidity Market Maker) pool, stemming from a numerical overflow error in an open-source library. The attacker exploited this vulnerability to manipulate liquidity and withdraw assets before the core CLMM pools were disabled. Currently, Cetus has fully fixed this issue.

Cetus’s incident is part of a series of significant attacks that have shaken the DeFi sector, such as the $200 million hack of the Mixin Network wallet (September 2023), the $323 million attack on the Wormhole bridge (February 2022), and the Ronin sidechain exploitation of Axie Infinity, resulting in losses of up to $600 million (March 2022).