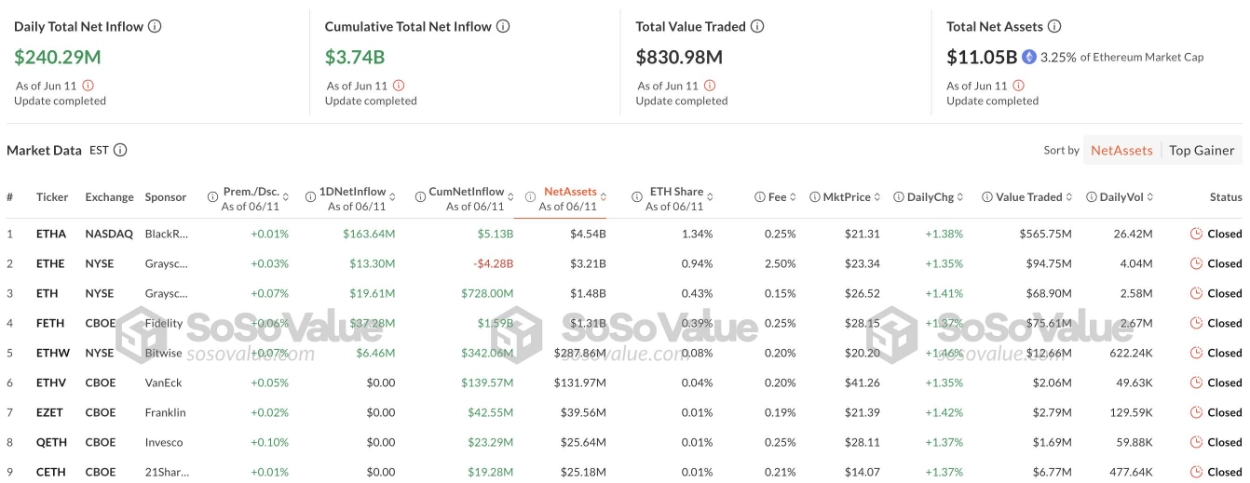

According to data from SoSoValue, spot Ethereum ETFs in the U.S. are becoming the center of attention, recording inflows of $240.3 million during trading on June 11 (U.S. time), far surpassing the $164.5 million in inflows for spot Bitcoin ETFs on the same day. Among these, BlackRock’s ETHA fund led with an inflow of $163.6 million, followed by Fidelity’s FBTC fund with $37.28 million. Other funds like Grayscale Mini Ethereum Trust, ETHE, and Bitwise’s BITW also reported positive inflows, reinforcing Ethereum’s appeal in the market.

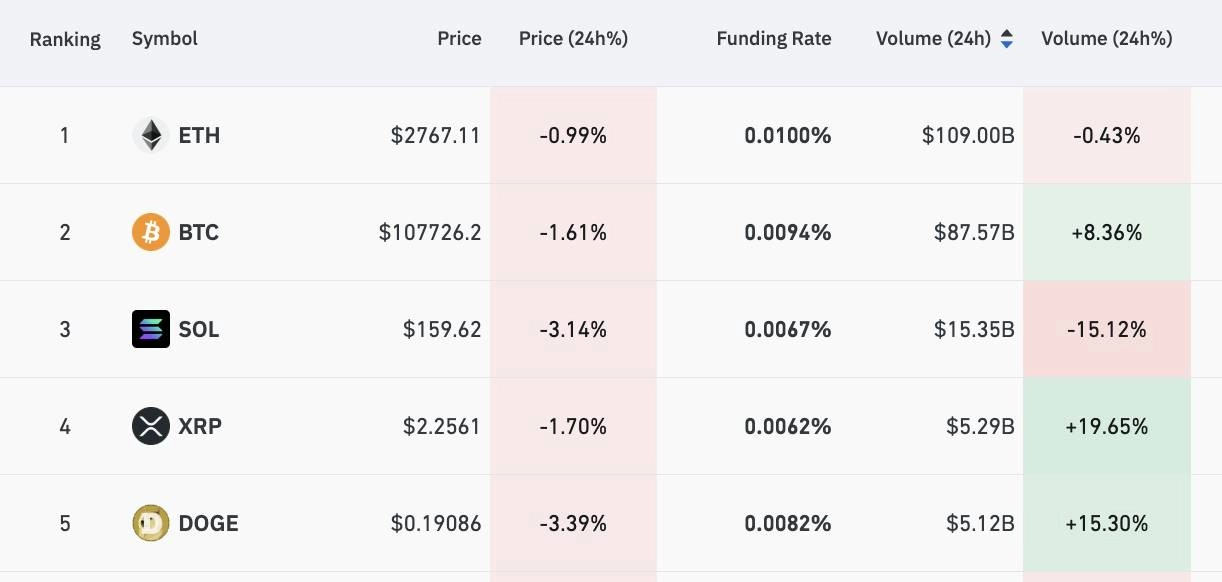

Notably, the trading volume of ETH derivatives has exceeded that of BTC, reaching over $109 billion in a day compared to Bitcoin’s $80.5 billion. This reflects the growing interest in ETH, expanding the influence of this cryptocurrency.

Drivers of Ethereum’s Surge

Mr. Augustine Fan, Director of Analysis at SignalPlus, noted that the breakout of ETH spot ETFs largely stems from spillover effects from Bitcoin. He shared:

When investors have had their fill of Bitcoin, especially under the influence of MicroStrategy and major ETFs, Ethereum is becoming the next destination. The Pectra upgrade and expectations for the revival of the DeFi sector are just catalysts, while market sentiment is shifting strongly toward ETH.

In agreement, Mr. Nick Ruck, Director of Research at LVRG, emphasized:

Investors now view Ethereum as an undervalued asset relative to its long-term potential. As Bitcoin has peaked, capital is seeking new opportunities, and Ethereum is the top choice.

Internal Changes Strengthening Confidence

The appeal of Ethereum is not only driven by market factors but also reinforced by internal reforms from the Ethereum Foundation. This organization recently restructured its leadership, clearly separating the Board of Directors from the Executive Board responsible for strategy and operations. This move has been well-received by the community, seen as a significant step toward enhancing transparency and responsiveness to network issues.

Additionally, the Pectra upgrade, successfully implemented in early May, has significantly improved network performance, reduced transaction costs, and paved the way for many future enhancements. These changes have alleviated previous criticism that the Ethereum Foundation was “out of touch” and “lacking practicality.”

Staking and ETF Prospects

Optimism surrounding ETH is further supported by a recent announcement from the U.S. Securities and Exchange Commission (SEC), affirming that staking activities do not violate securities laws. This is seen as an important stepping stone, opening the possibility of integrating ETH staking into future ETF products, providing new income streams for investors. However, the SEC has yet to approve any staking ETF proposals as of now.

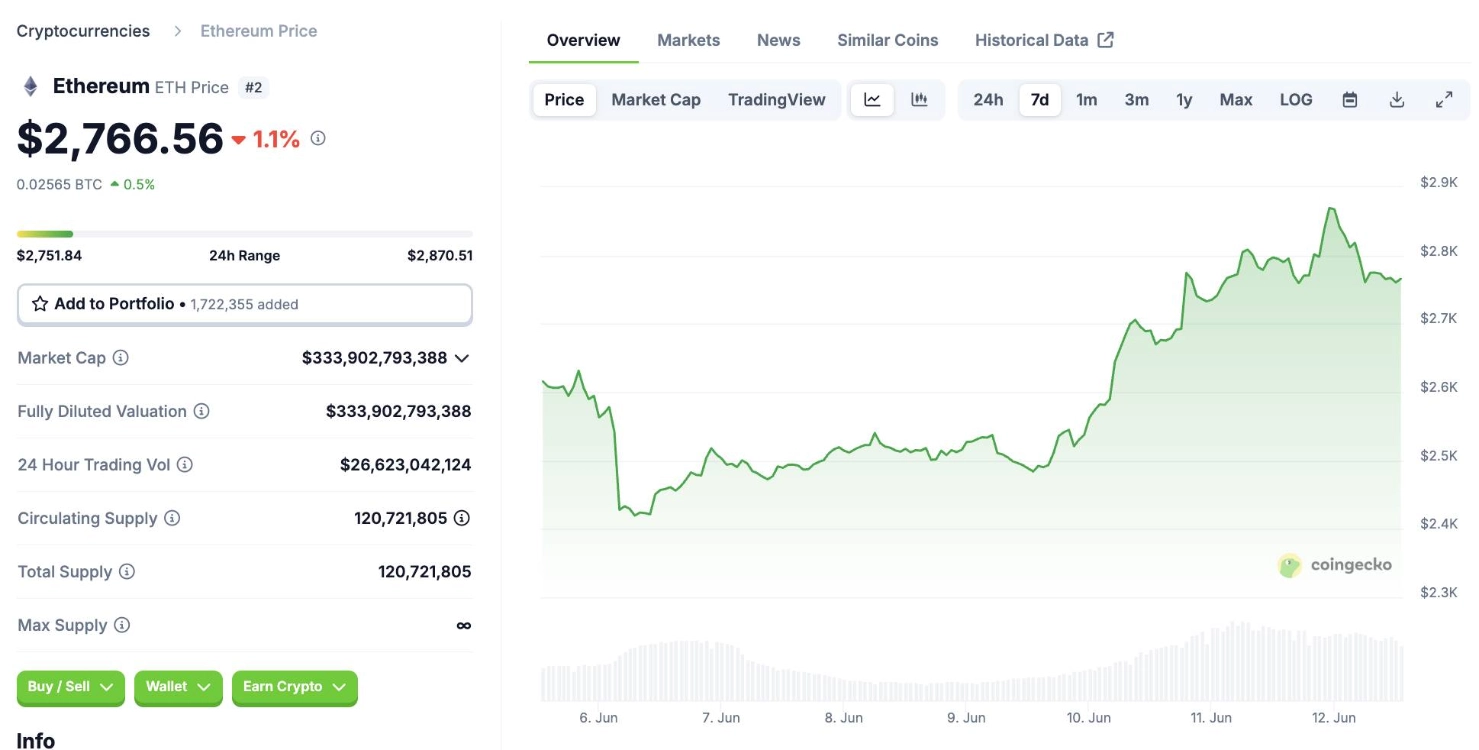

In the past 24 hours, ETH’s price has slightly decreased by 1.06%, currently trading around $2,766. Previously, ETH had an impressive increase of over 15%, rising from the $2,420 range to a peak of $2,867. With positive factors from both the market and internal developments, Ethereum is solidifying its position as a potentially attractive investment destination in the increasingly vibrant cryptocurrency landscape.