The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), digitized in partnership with Securitize, is expanding from the Ethereum platform to several new blockchains, including Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

This expansion will enhance direct interaction with BUIDL, making the fund more accessible to investors, decentralized autonomous organizations (DAOs), and businesses in the digital asset sector. According to Securitize, this move enables developers to build applications on their preferred blockchain, thereby broadening BUIDL’s application potential. Notably, the digitized fund offers key advantages such as on-chain yield, dividend accumulation, and fast transaction capabilities between parties.

Carlos Domingo, CEO and co-founder of Securitize, stated:

We aim to develop a specialized ecosystem that maximizes the potential of tokenization technology. As the trend toward real-world asset (RWA) digitization continues to grow, expanding to new blockchains will further drive the BUIDL ecosystem. This not only attracts more investors but also provides opportunities for them to optimize capital operations that have previously faced significant challenges.

BNY Mellon will continue to manage and custody BUIDL across Ethereum and the newly added blockchains.

Previously, Franklin Templeton pioneered with the OnChain U.S. Government Money Fund (FOBXX) — the first fund in the U.S. to use a public blockchain to record share ownership via the BENJI token since 2021. Currently, FOBXX operates on several blockchains, including Aptos, Arbitrum, Avalanche, Stellar, and Polygon.

Related: BlackRock Bitcoin ETF Fund Surpasses $30 Billion

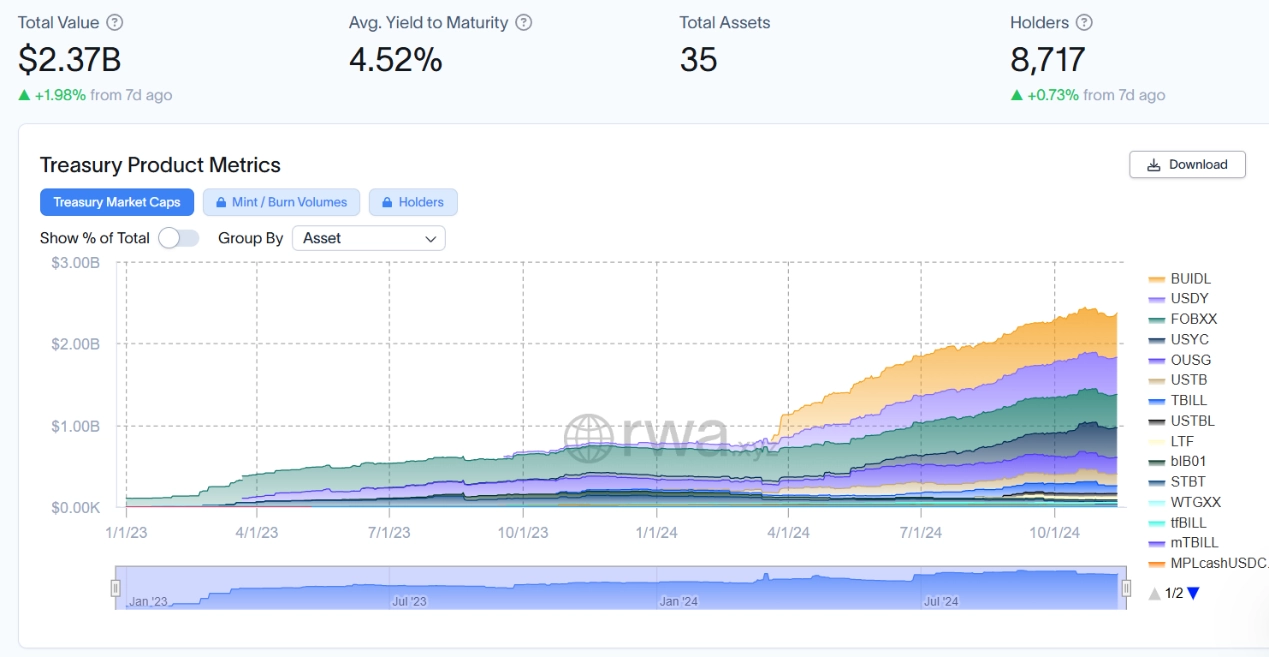

However, BlackRock’s BUIDL fund has quickly captured the market for digitized government securities. Just 40 days after its launch in March, BUIDL became the largest fund in this segment, with total assets under management reaching $517 million, accounting for 22% of the market share in the $2.3 billion segment (according to data from 21.co, the parent company of Bitcoin ETF provider 21Shares).