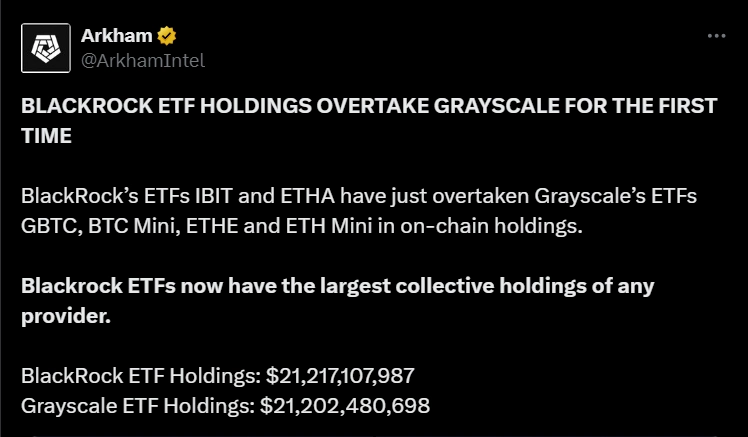

BlackRock, the asset management giant, made history in the crypto ETF market on August 18, 2024. With just two ETFs, IBIT (Bitcoin) and ETHA (Ethereum), BlackRock surpassed Grayscale to become the world’s largest crypto ETF manager in terms of total assets under management (AUM).

BlackRock’s Rapid Ascent

According to data from Arkham, the total AUM of BlackRock’s two ETFs has reached $21.6 billion, surpassing the $21.3 billion AUM of Grayscale’s four crypto ETFs (GBTC, BTC Mini, ETHE, and ETH Mini). This is an incredible achievement, especially considering the relatively short operation period of BlackRock’s ETFs.

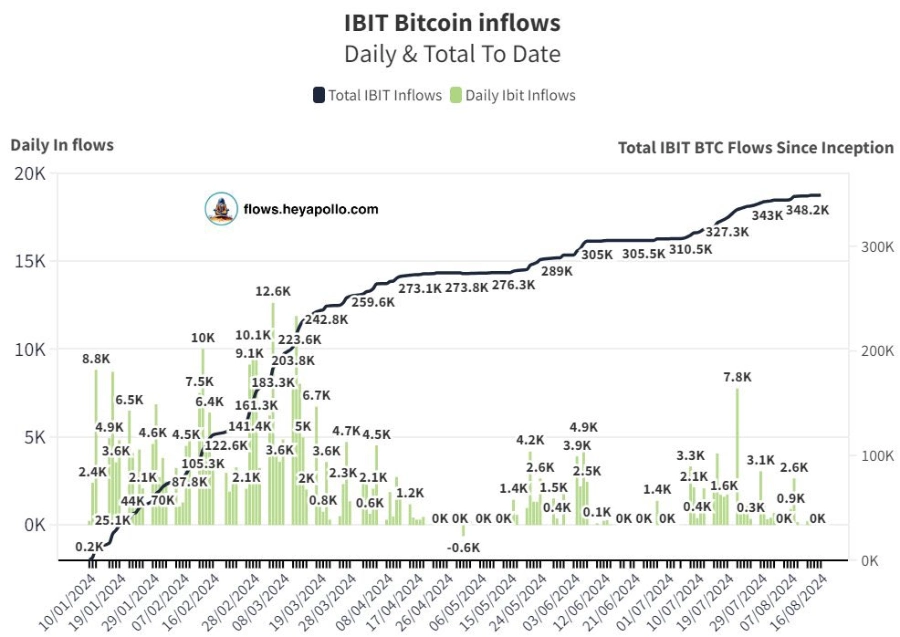

IBIT: A Promising Bitcoin Spot ETF

- Became the largest Bitcoin ETF in less than six months (05/2024)

- Currently holds 348,943 BTC, equivalent to $20.4 billion

- Has recorded only one outflow day since SEC approval

ETHA: A Promising Newcomer in the Ethereum ETF Market

- Ranked 3rd in the market with $845.48 million AUM

- Has not recorded any negative outflow days since listing (07/23/2024)

- Net inflow reached $977.62 million

Grayscale: Facing Significant Challenges

While BlackRock is experiencing strong growth, Grayscale is facing numerous difficulties:

GBTC (Bitcoin Trust):

- Lost 389,454 BTC ($22.8 billion) due to continuous outflows

- Lost its leading position in the Bitcoin spot ETF market

ETHE (Ethereum Trust):

- Manages $4.89 billion in assets but faces significant selling pressure

- Recorded net outflows of up to $2.41 billion

- High management fees (2.5%) are driving investors to other funds

Related: SEC Approves Ethereum Spot ETF Trading Starting Today

Insights and Prospects

BlackRock’s success reflects investor confidence in the company’s crypto ETF products. It also indicates a market trend towards funds with more competitive management fees.

Nate Geraci, President of The ETF Store, stated:

Since the SEC approved Bitcoin spot ETFs, BlackRock’s IBIT has only recorded one outflow day. This is a remarkable achievement, demonstrating BlackRock’s strong appeal in the crypto ETF market.

With its current growth trajectory, BlackRock is steadily establishing itself as a leader in the crypto ETF sector. This promises to bring significant changes to market structure and investment methods in digital assets in the future.