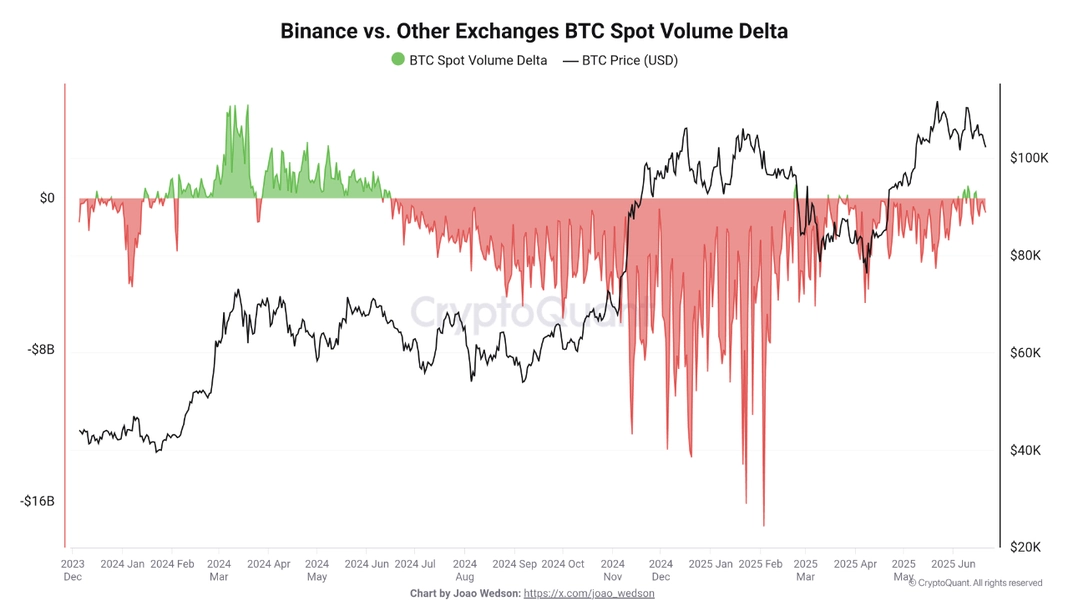

Binance continues to assert its leading position in the cryptocurrency trading sector as the spot trading volume of Bitcoin on its platform far exceeds the total volume of all other exchanges combined, according to the latest report from CryptoQuant. This trend is raising expectations for a strong price increase of Bitcoin in the near future.

Binance Dominates the Spot Market

Data from CryptoQuant shows that the spot trading volume of Bitcoin on Binance is currently more than 10 times that of Coinbase, demonstrating the exchange’s superior liquidity concentration. This dominance not only reinforces Binance’s role but also highlights its significant influence on the entire cryptocurrency market.

According to CryptoQuant, the “Delta volume index of Binance compared to other exchanges” is approaching a positive crossover—a signal that has previously appeared before Bitcoin’s price increases in past cycles. As Binance excels in trading volume, it reflects strong interest from both retail and institutional investors, signaling the potential for a bullish reversal during the current accumulation phase.

Related: Trump’s Memecoin $TRUMP Sold Off Just Before US-Iran Conflict

Why Is This Important?

Binance’s dominance in spot trading reveals several important trends:

- Concentrated Liquidity: This allows Bitcoin prices to be more accurately priced and to respond quickly to market developments.

- Increased Confidence: The return of both retail investors and “whales” on Binance demonstrates strong confidence in the platform amidst market volatility.

- Real Buying Demand: The growth in spot volume, rather than a focus on derivatives, indicates real demand for purchasing Bitcoin, distinct from speculative activities using leverage.

With these positive signals, traders are hoping that Bitcoin may soon break out, marking a new phase in the market cycle.