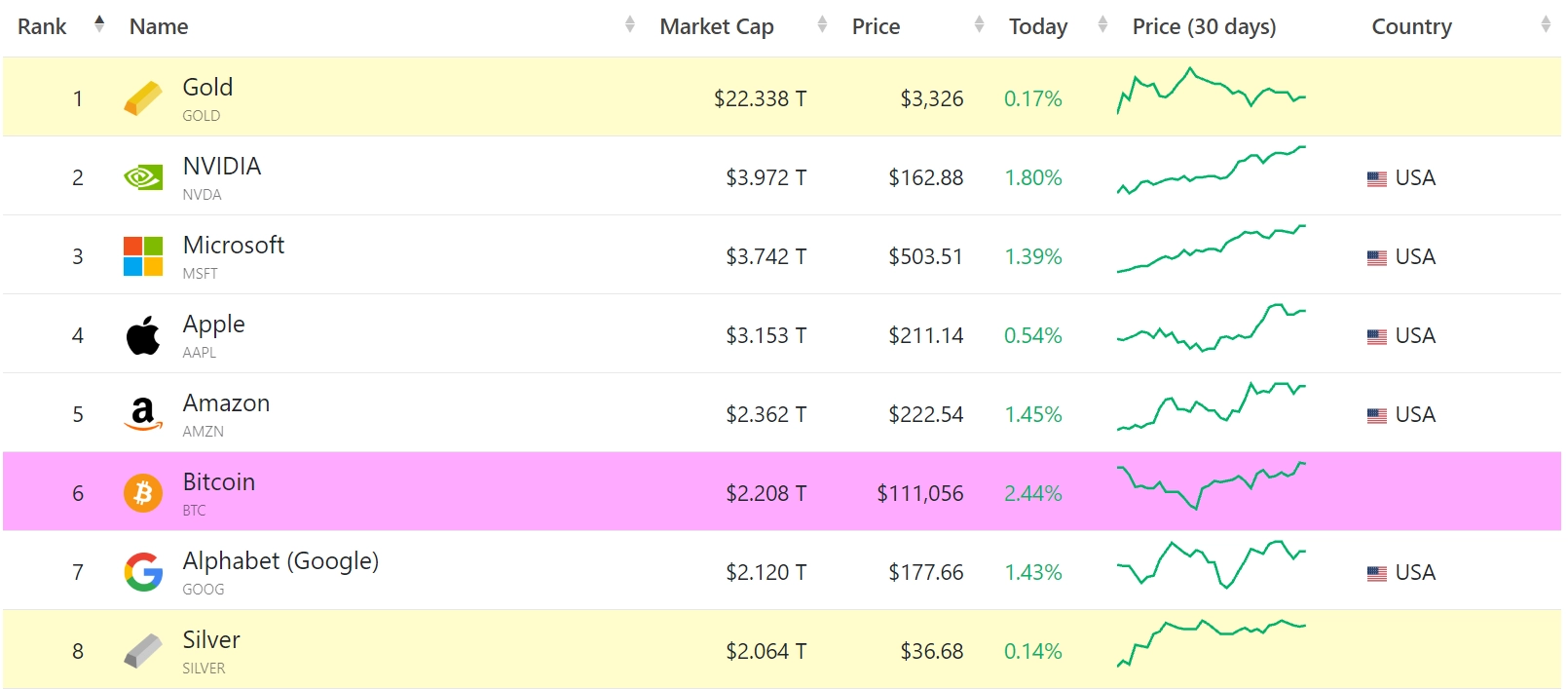

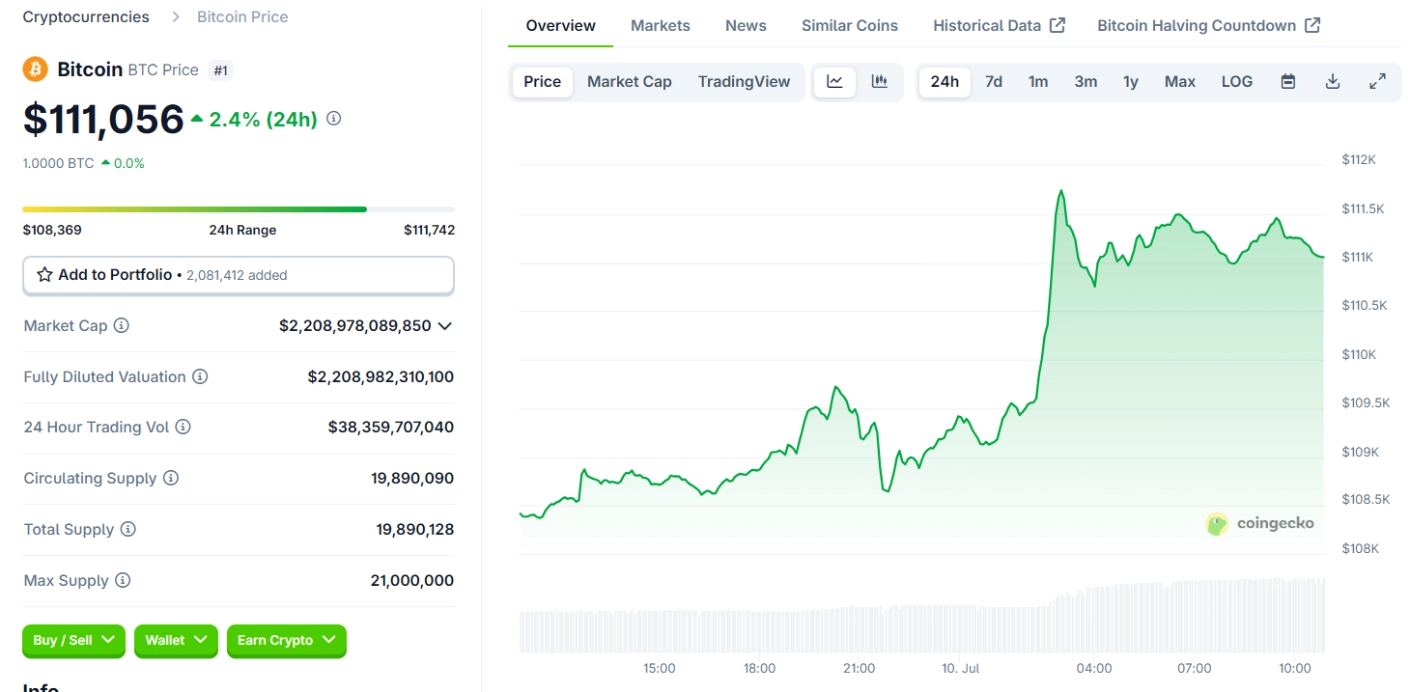

On July 9, 2025, Bitcoin (BTC) marked a historic milestone by surpassing tech giant Google (Alphabet Inc.) to become the sixth-largest asset by market capitalization globally. With a price reaching $111,900, Bitcoin achieved a market cap of $2.21 trillion, surpassing Google’s $2.02 trillion.

Bitcoin’s breakout occurred amid a bullish market sentiment, driven by several macroeconomic factors. Investors are increasingly viewing Bitcoin as a safe haven asset against inflation, monetary policy uncertainty, and geopolitical tensions. According to a report from US Crypto News, Bitcoin is emerging as a risk hedge for the traditional financial system and U.S. Treasury bonds. Additionally, the easing of trade tensions between the U.S. and China, along with significant capital flowing into Bitcoin ETF funds in the U.S., has contributed to the cryptocurrency’s rising value. Just in the past week, Bitcoin ETFs recorded a net inflow of up to $936 million, reflecting strong interest from institutional investors.

Notably, actions from the Trump administration also played an important role. An executive order establishing the Strategic Bitcoin Reserve and supportive statements about cryptocurrency from Trump’s allies in Congress have helped bolster confidence in Bitcoin. Furthermore, major financial institutions like JPMorgan Chase, Morgan Stanley, and BlackRock have begun participating in the cryptocurrency market, marking an increasing acceptance of this asset class.

Related: Pump.fun Officially Launches Token Sale with FDV Reaching $4 Billion

Meanwhile, Google is facing challenges such as legal pressures, antitrust lawsuits, and a decline in digital advertising revenue, impacting its market capitalization. Bitcoin’s rise not only reflects the strength of decentralized blockchain technology but also indicates a shift in investor perception toward alternative assets amid a weakening U.S. dollar and volatile stock markets.

Experts believe that Bitcoin’s growth momentum is far from over. Geoff Kendrick, head of digital asset research at Standard Chartered, predicts that Bitcoin could reach $200,000 by the end of 2025 and even hit $500,000 by 2028, thanks to its increasingly important role in global investment portfolios. However, investors are also advised about the high volatility of cryptocurrencies and should conduct thorough research before entering the market.