In a recent interview with CNBC Television, Mr. Matt Hougan, Chief Investment Officer (CIO) of Bitwise, one of the leading cryptocurrency asset management companies, provided an optimistic outlook on Bitcoin’s price prospects.

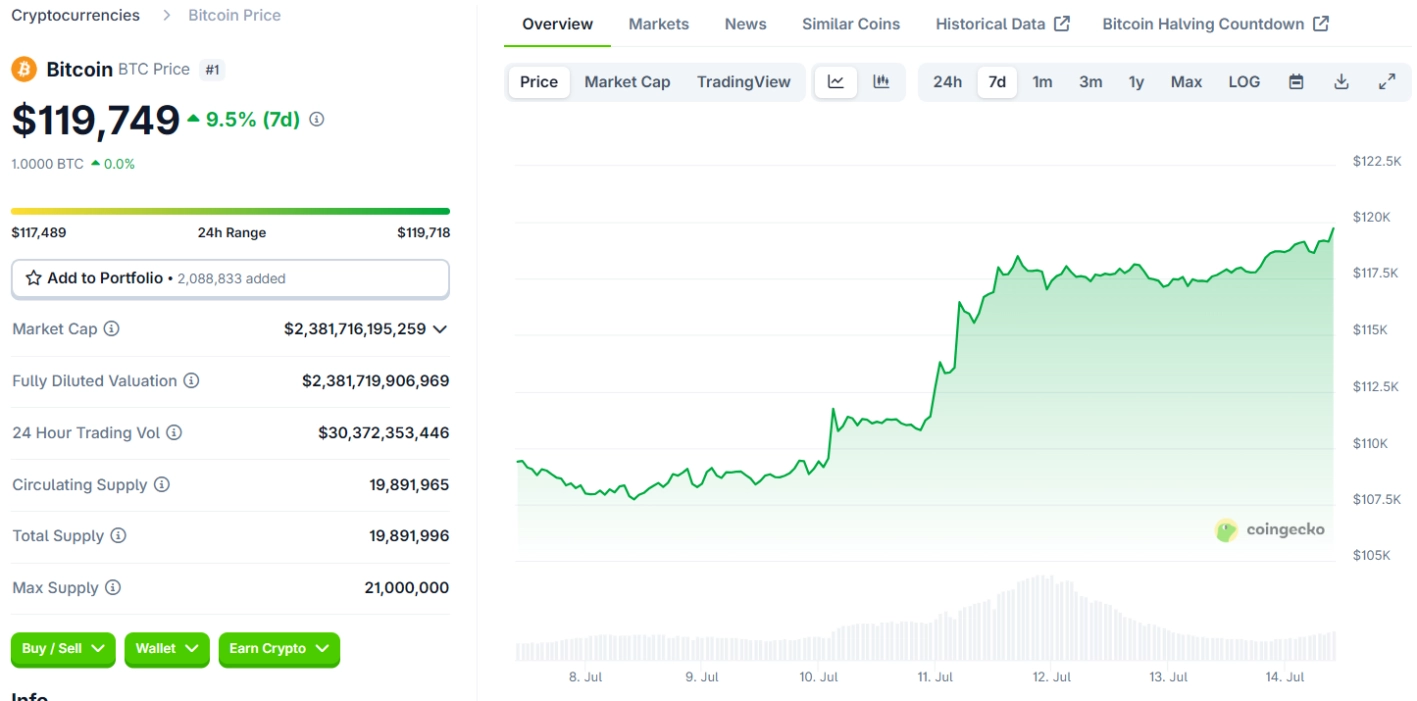

According to him, the combination of surging demand from large institutions and limited supply could push Bitcoin’s price up by 70% from its current level, potentially reaching $200,000 before the end of 2025.

Supply Cannot Meet Demand

Mr. Hougan emphasized the stark imbalance in the current Bitcoin market. He analyzed:

Every day, the Bitcoin network only mines about 450 BTC, but just yesterday, ETF funds accumulated up to 10,000 BTC. This represents unprecedented buying pressure in history.

The disparity between supply and demand is creating strong momentum driving Bitcoin’s price growth.

Related: Robinhood Launches Ethereum and Solana Staking for U.S. Users

Momentum from Institutional Investors

According to Mr. Hougan, the involvement of major financial institutions in the Bitcoin market is a historic turning point. This process is not just a short-term phenomenon; it will last for many years, but the effects are already becoming evident.

When demand exceeds supply, Bitcoin’s price will continue to rise. I believe Bitcoin still has a long growth path ahead, and the $200,000 mark by the end of the year is entirely feasible.

Bitcoin as a “Safe Haven” Asset in Times of Turmoil

In addition to supply and demand factors, Mr. Hougan pointed out Bitcoin’s increasingly important role as a safe-store of value. In the context of global economic and political instability, characterized by geopolitical tensions and risks from tariff policies, Bitcoin is becoming the top choice for investors seeking decentralized solutions.

Bitcoin is not just a digital asset; it is also a safe haven for wealth during turbulent times.