The cryptocurrency market is entering its most challenging phase of the year as Bitcoin begins September under strong selling pressure. After a 6.49% decrease in August, the world’s leading digital currency opened September at 108,253 USD, marking the start of a period traders refer to as “Red September,” the weakest phase of the year.

From 2013 to the present, Bitcoin has recorded an average loss of 3.77% in September, with 8 years of price declines out of the 11 years observed. This phenomenon is not exclusive to the cryptocurrency market; Wall Street has also experienced sell-offs in September for nearly a century.

However, this year the situation appears much more unstable compared to previous years.

Compounding Global Risks

The current global economic situation is adding pressure on Bitcoin. Inflation in the U.S. remains at 3.1%, two major wars are disrupting global supply chains, and trade tensions are escalating.

Daniel Keller from InFlux Technologies commented:

“The current global geopolitical situation puts BTC in a perfect position for a significant drop in September 2025.”

Technical Analysis and Cash Flow

Bitcoin has broken the support level of 110,000 USD, a crucial threshold since May. The current resistance level is near 114,000 USD, while analysts are monitoring the threshold of 103,000 USD. The possibility of the price testing the 100,000 USD mark is entirely plausible.

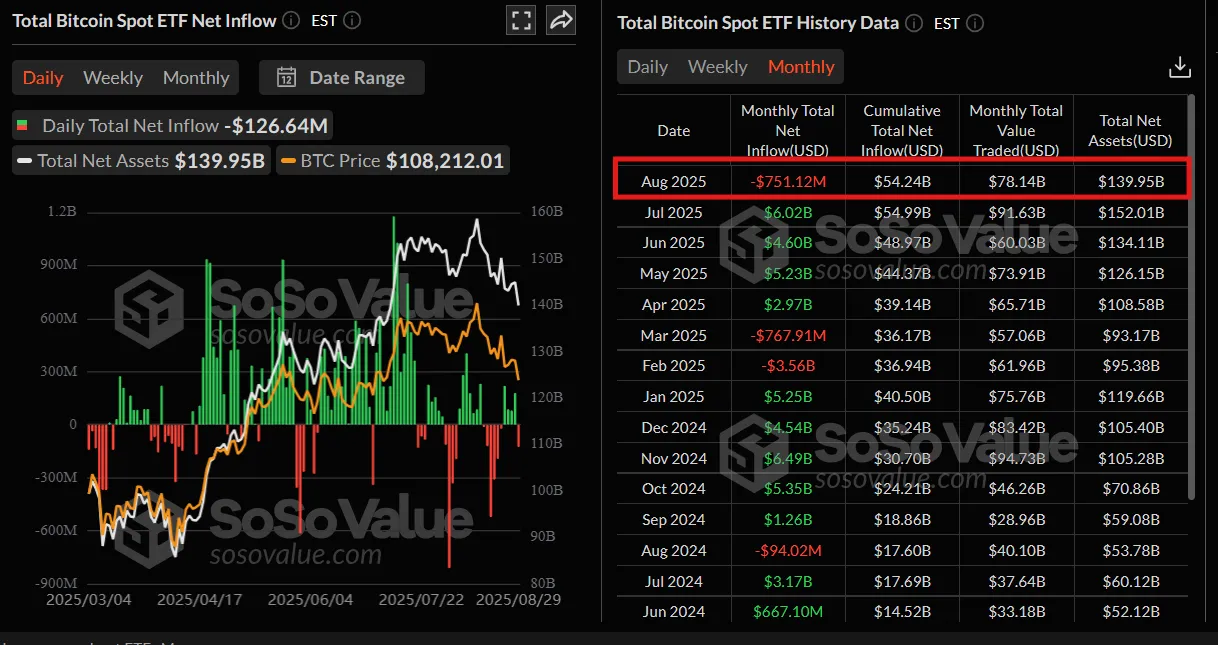

Data from ETF funds indicate an outflow of 751 million USD, reflecting caution among institutional investors. However, the number of “whale” wallets has increased to a record 19,130 addresses, suggesting that some large investors are accumulating as prices drop.

A Volatile September

September will be a critical phase with many events that could strongly influence the crypto market. Important economic data from the U.S. will be released in the first week, ahead of the Fed meeting on September 16-17.

Fed Governor Christopher Waller supports a 25 basis point rate cut. According to CME’s FedWatch tool, the likelihood of the Fed cutting rates is 90%, a positive development that could support the Bitcoin market.

Related: 1 Billion Dollars Will Be Unlocked in September 2025

Remarks and Evaluation

“Red September” in 2025 could become the biggest challenge for Bitcoin this year. The combination of historical factors, negative market sentiment, and a complex economic and geopolitical backdrop is creating a “minor adjustment” for the crypto market.

However, the fact that whales are still accumulating and the high likelihood of the Fed cutting rates suggest not everything is pessimistic. This could be a phase that separates short-term investors from long-term ones.

With expected high volatility, investors need to be particularly cautious in managing risk and avoid using excessive leverage during this time. The coming weeks will determine whether Bitcoin can overcome the “September curse” or continue to sink deeper.