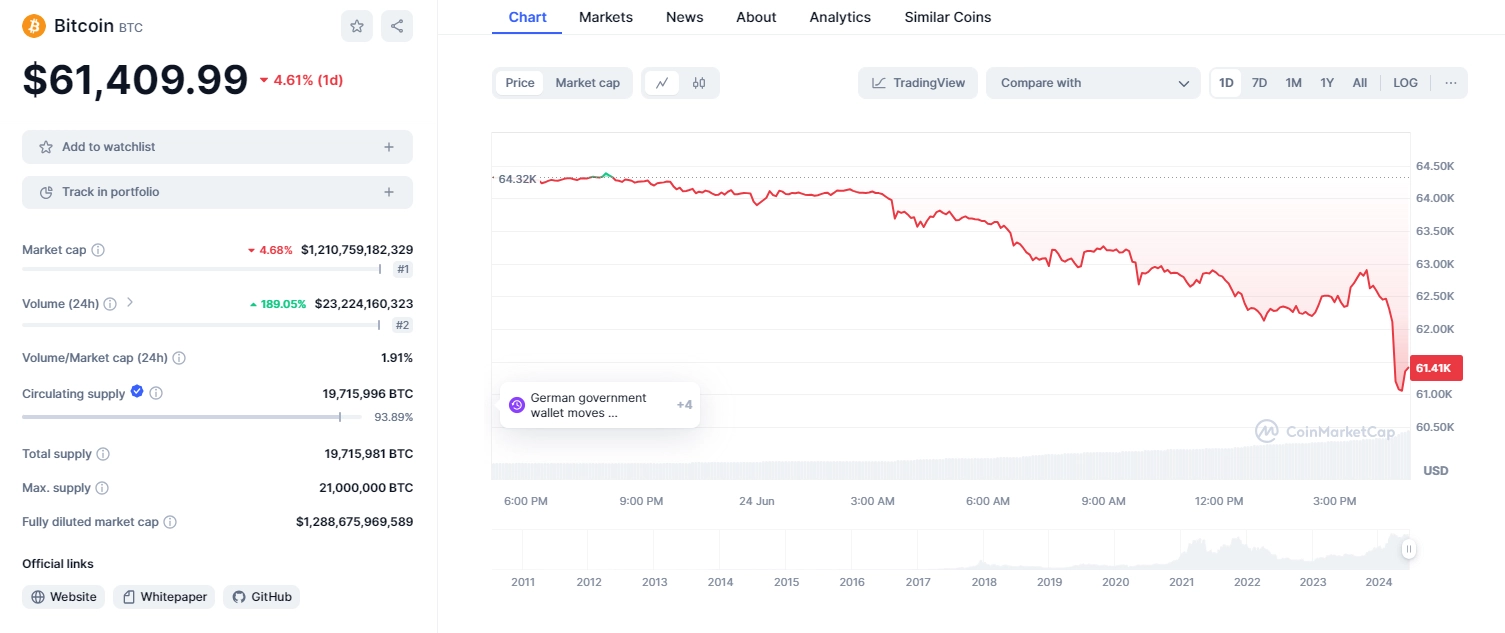

Bitcoin enters the last week of June with a notable adjustment, approaching the lower end of its trading range as it edges towards the $60,000 mark. Since the close on June 24th, Bitcoin’s price has hovered around $60,000 to $61,000, sparking concerns among investors as the cryptocurrency delves deeper into a crucial resistance zone. In today’s trading alone, Bitcoin has already dropped by approximately $4,000.

The pressing question in the coming days, as we approach the monthly and quarterly close, is whether Bitcoin can sustain this price level or if it will continue to slide to lower regions. To reach this point, Bitcoin has already surrendered several critical moving averages, putting short-term investors in a loss as the price dips below their aggregate cost basis.

Factors to Watch Right Now

Currently, Bitcoin’s demand is facing a temporary setback, and all eyes are on the “whales” (large investors) as the price hits its lowest level in over a month. These whales, who previously showed strong buying power, are now exhibiting significant selling pressure.

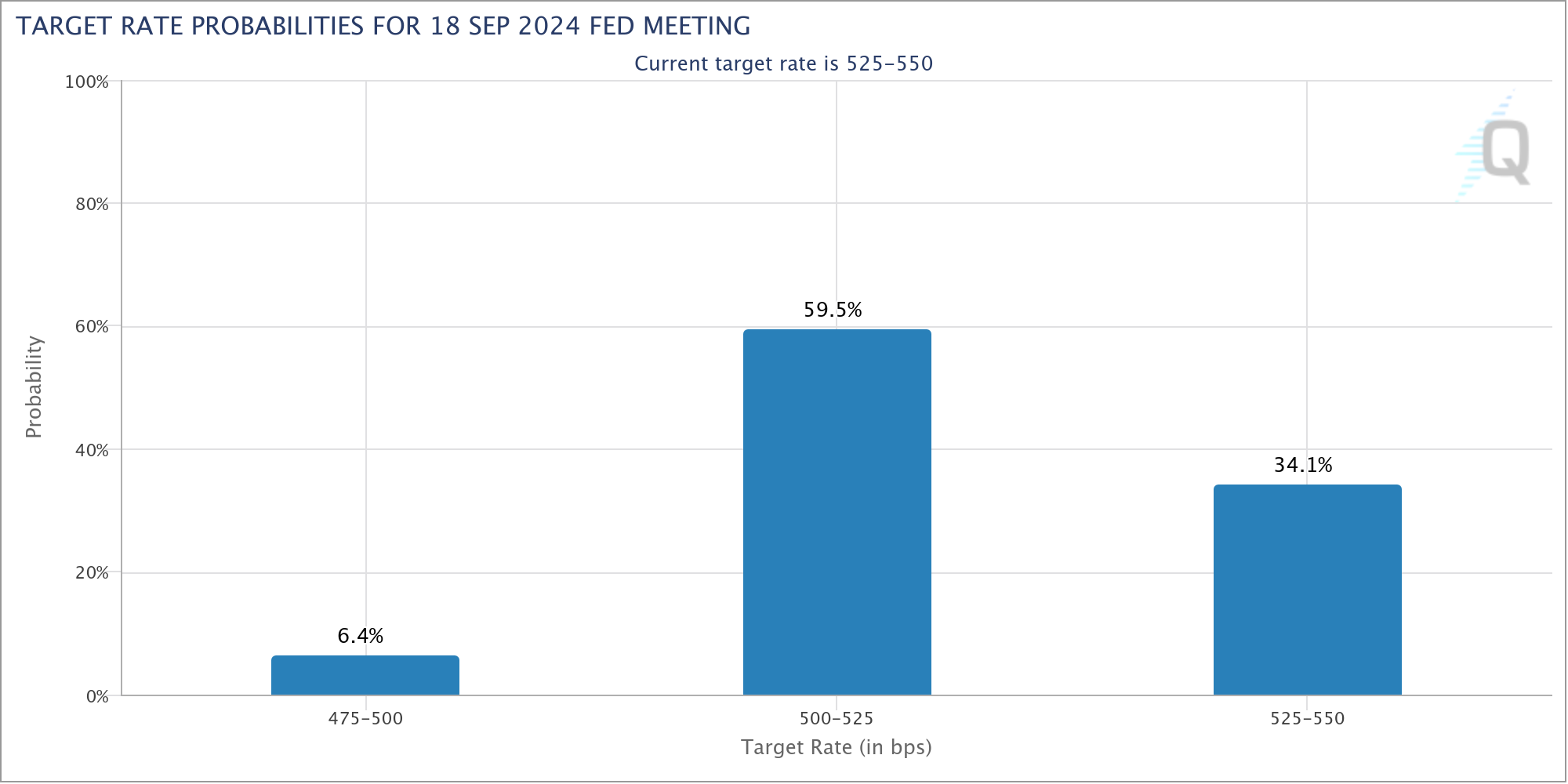

Upcoming economic factors include the release of U.S. unemployment data on June 28, adjusted second-quarter GDP figures, and the Personal Consumption Expenditures (PCE) index, which the Federal Reserve (Fed) closely monitors as a preferred measure of inflation.

“Bitcoin looks weaker than I expected and may continue to decline,” commented renowned trader Crypto Ed on X. He also warned that altcoins, already under pressure from Bitcoin’s price drop, could see another 20% decline.

Trader Daan Crypto Trades highlighted crucial levels within Bitcoin’s long-term trading range, stating:

“Bitcoin has hit the Fibonacci support level at $60,000. If there’s still buying power, this could set a higher low. Otherwise, we are likely to see another test of the range bottom.”

In the latter half of this week, the market will closely monitor critical macroeconomic data, including unemployment claims, second-quarter GDP, and the May PCE index. The crypto market has shown sensitivity to unemployment data, particularly in 2024, and the PCE index remains a key measure for the Fed’s assessment of inflation.

Related: Willy Woo Explains Why Bitcoin Cannot Recover

Market Sentiment

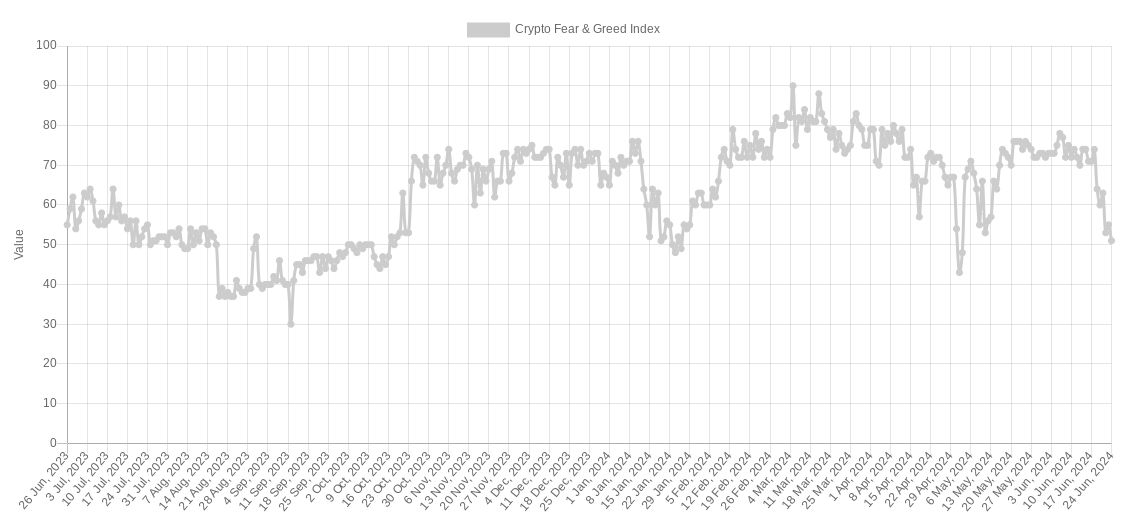

Investor sentiment is currently hovering at its lowest level for 2024, with the Crypto Fear and Greed Index at 51/100 as of June 24th. Just a week ago, the index was nearing “extreme greed,” but now it is edging towards the “fear” zone.

Despite the challenges Bitcoin faces, the interest and accumulation from major investors suggest a potential recovery in the future. As the market adjusts and new economic factors are revealed, this week could be pivotal for Bitcoin and the broader cryptocurrency market.