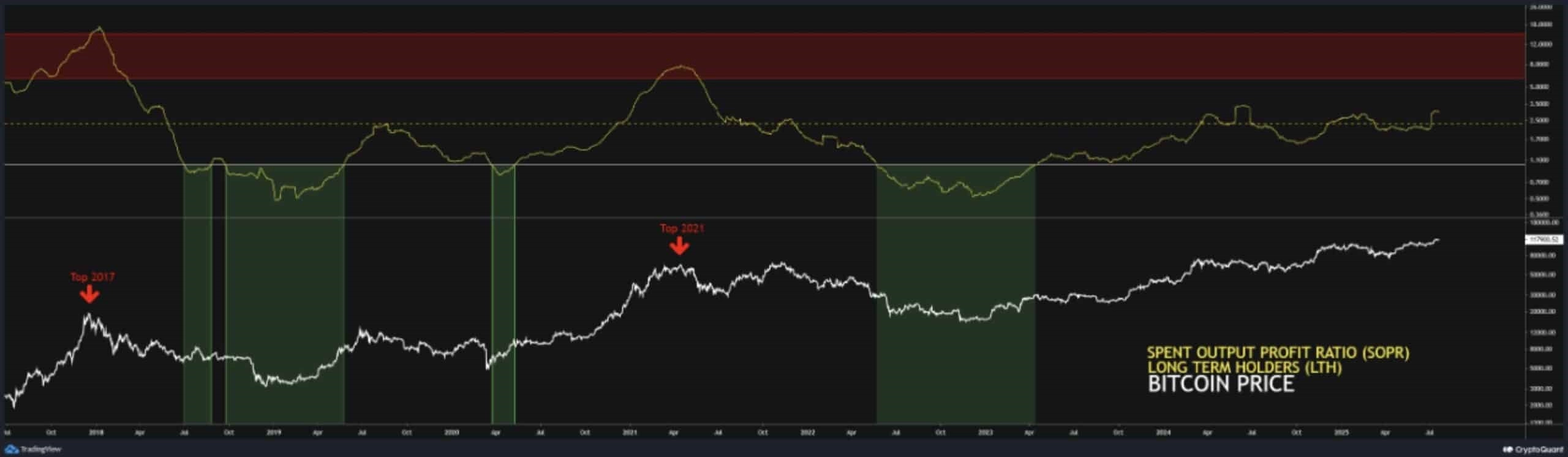

According to data from CryptoQuant, long-term Bitcoin holders have begun selling to take profits over the past 24 hours.

The Spent Output Profit Ratio (SOPR), which measures the level of profit when Bitcoin is sold, has exceeded 2.5, the highest level in 2025. However, the SOPR has not yet reached 4, a threshold that historically signals local price peaks (as seen in 2021). This indicates that even though Bitcoin’s price is only about $5,000 away from its all-time high, long-term investors have not completely exited the market. This is a positive signal, suggesting that Bitcoin still has short-term growth potential.

On the other hand, the Binary Coin Days Destroyed (Binary CDD) indicator has recorded a value of 1, indicating that selling activity is still ongoing. If this trend persists, Bitcoin may face downward pressure from the current range (~$123,000).

Despite the ongoing profit-taking, other market signals reflect optimism:

- Whale Ratio: The CryptoQuant Whale Ratio is currently at 0.42, indicating that whales are actively trading and maintaining a positive outlook. Recent price increases partially reflect this positive momentum.

- Miner Position Index (MPI): The MPI is currently at -0.2 and trending upward. When MPI is in negative territory, it suggests that miners are holding onto their Bitcoin rather than selling. This behavior can reduce circulating supply, creating conditions for a supply squeeze, which often drives prices up.

Related: Did Jerome Powell Resign as Fed Chair?

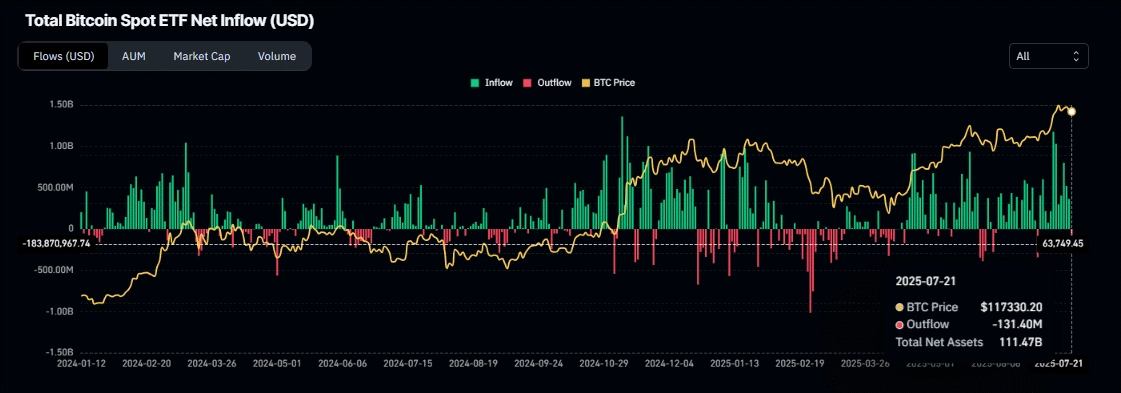

In the past 24 hours, institutional investors have shifted to a cautious stance, selling $131.4 million worth of Bitcoin, ending a streak of 12 consecutive days of net buying. However, their total holdings remain at $111.47 billion (according to CoinGlass), indicating that this may be more of a short-term profit-taking move rather than a sign of long-term pessimism.

If buying pressure from institutions returns, Bitcoin could quickly break out of its current consolidation phase and continue its upward trend.