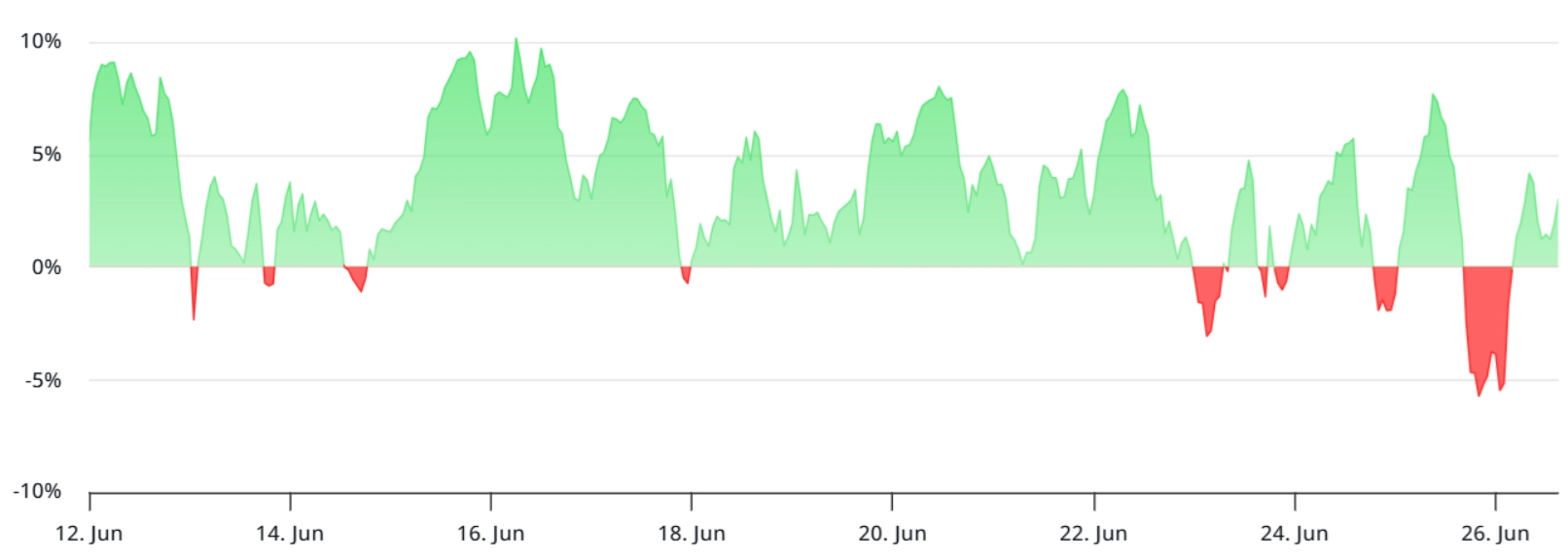

Bitcoin has plunged below the $100,000 mark following Iran’s attacks on a U.S. military base in Qatar. Although the price quickly rebounded to $108,000, cautious sentiment is prevailing in the market.

According to market data, the funding rate for Bitcoin futures has dropped to its lowest level in seven weeks, a negative sign in the context of an overall bullish trend. This decline indicates weakening demand for leverage, reflecting concerns that a correction may be imminent for Bitcoin.

Currently, Bitcoin is under pressure from escalating global trade tensions. The tariff war initiated by the U.S. in April has entered a phase of instability, with many temporary agreements, including one with the eurozone, set to expire on July 9. The continuously changing tax policies under President Donald Trump’s administration have created uncertainty for investors, increasing macroeconomic risks in the financial market.

Additionally, the U.S. economy is facing troubling signals. The latest report shows that Q1 2025 GDP has decreased by 0.5% compared to the same period last year, a figure seen as a consequence of rising trade deficits. This weakness further raises concerns about the negative impact on riskier assets like Bitcoin.

Related: Tether Aims to Become the World’s Largest Bitcoin Mining Company

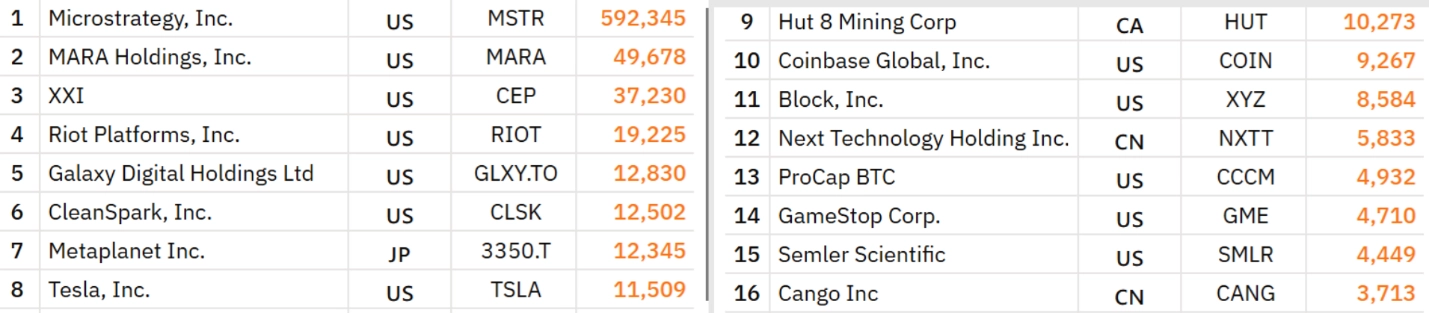

Another noteworthy development is the move from Bitcoin mining companies. Bit Digital (BTBT), a mining company based in New York, has announced plans to sell its entire mining operation and its holding of 417.6 BTC to invest in ETH. This move raises concerns that other miners might also liquidate Bitcoin, especially as mining revenue has dropped to a two-month low. This could add further downward pressure in the short term.

Despite facing various challenges, Bitcoin still receives support from long-term macroeconomic factors. Expectations for monetary policy easing from central banks, particularly the U.S. Federal Reserve (Fed), are seen as a driver for Bitcoin’s sustained upward momentum in the medium to long term. However, in the short term, the risk of Bitcoin’s price falling below the $100,000 mark remains a scenario that could very well happen, especially as market sentiment continues to be affected by geopolitical and economic instability.