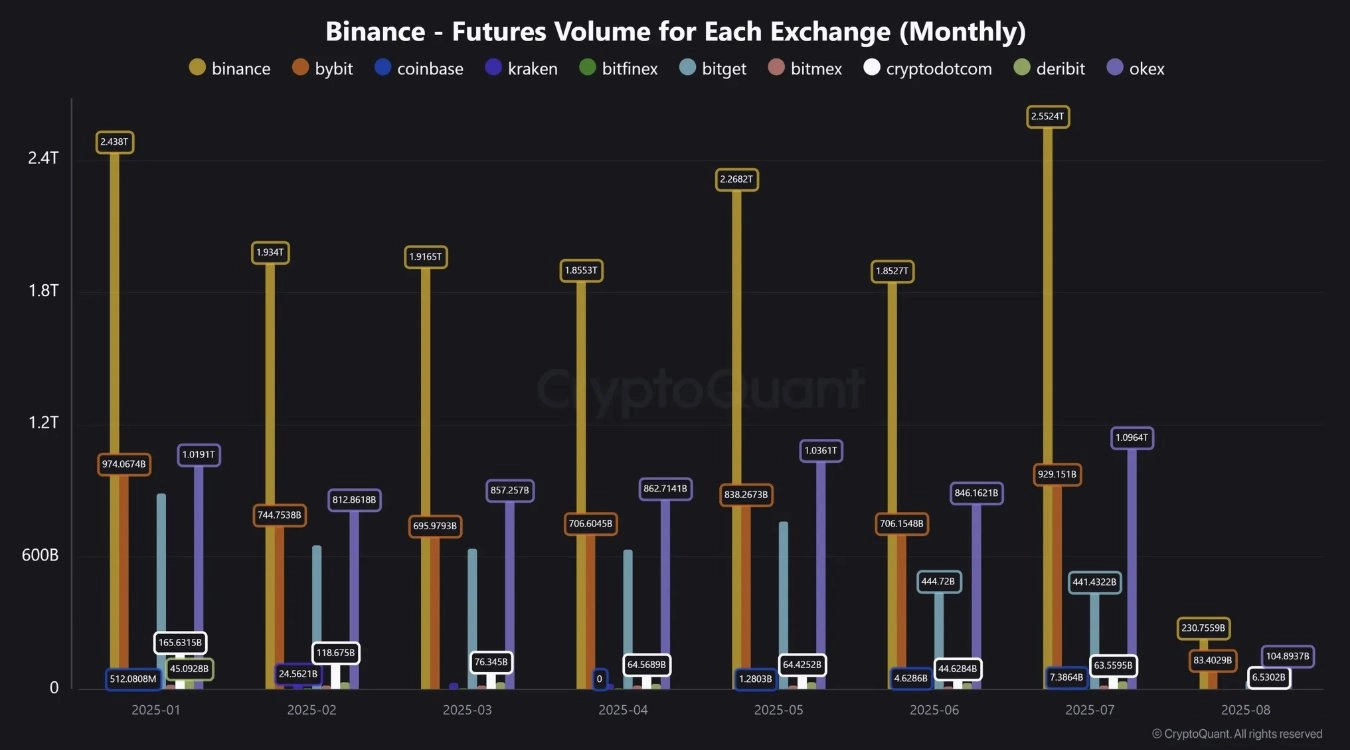

According to the latest data released, Binance recorded a futures trading volume of $2.55 trillion in July 2025, the most impressive figure since the beginning of the year. This growth is attributed to the recent volatility of Bitcoin and altcoins.

Binance Continues to Dominate the Market

With a trading volume of $2.55 trillion, Binance accounted for more than half of the total futures trading volume in the market, solidifying its unshakeable leadership position in the cryptocurrency derivatives trading sector.

This dominance is driven by several factors, notably high liquidity and a diverse range of altcoins offered by Binance. The platform continually adds new tokens, creating numerous attractive trading opportunities for investors.

While unable to match Binance, other major exchanges also saw vibrant trading activity. Bybit reported a trading volume of $929 billion, while OKX reached $1.09 trillion during the same period.

This figure indicates that the entire cryptocurrency trading industry is experiencing a strong recovery phase, with active participation from investors worldwide.

Related: Binance Announces 31st Project on HODLer Airdrops: Succinct (PROVE)

Signs of Market Recovery

The significant increase in futures trading volume is viewed by analysts as a positive indicator that users are gradually returning to the cryptocurrency market. This trend may be fueled by the recent price breakout of Bitcoin and many other altcoins.

The strong fluctuations of Bitcoin and other major cryptocurrencies have created numerous arbitrage and trading opportunities, attracting interest from both retail and institutional investors.

This record trading volume not only reflects the market’s recovery but also shows the growing confidence of investors in cryptocurrency derivatives products.

With Binance continuing to expand its product offerings and improve user experience, along with increasing competition from rivals like Bybit and OKX, the crypto futures trading market is expected to continue to grow robustly in the coming months.

This growth also reflects the increasingly mainstream trend of the cryptocurrency market, as more institutional and individual investors engage in more complex trading activities.