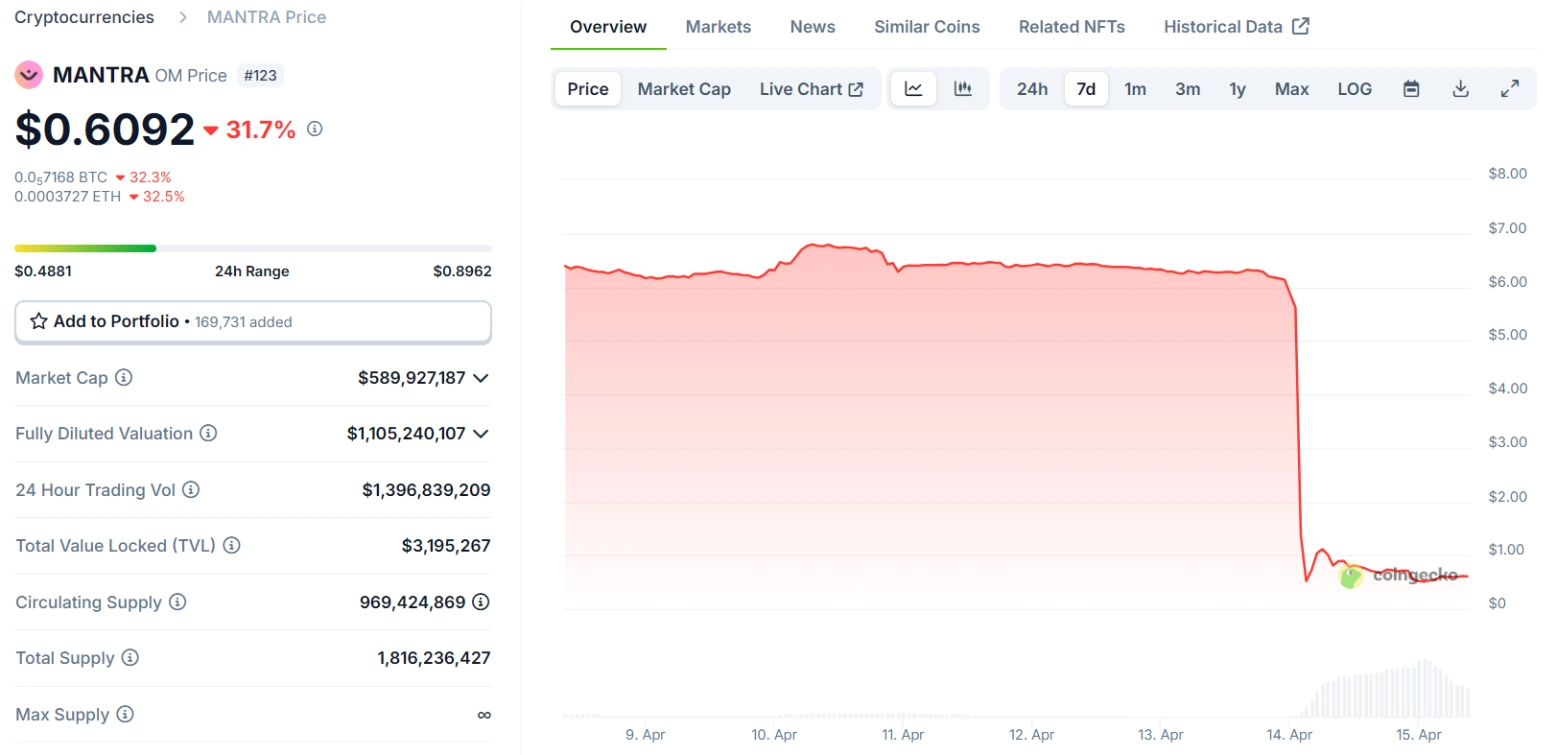

The collapse of Mantra (OM)—one of the most prominent real-world asset (RWA) tokenization protocols—has become a hot topic within the crypto community this past week. Amid a wave of accusations from the community blaming exchanges for the failure, Binance has officially addressed the situation via its X (formerly Twitter) account.

Binance Explains the Reasons Behind Mantra’s Collapse

According to Binance, the downfall of Mantra (OM) was primarily caused by cross-exchange liquidations. As a risk control measure, Binance proactively reduced leverage on OM tokens. Notably, the exchange stated that it had warned users as early as January about changes in the project’s tokenomics via announcements on the spot trading page.

The market crash occurred when OM’s token price plummeted by over 90% in just one hour, dropping from $6.31 to $0.70. Within 24 hours, total liquidations amounted to $74.52 million, even surpassing Ethereum in liquidation volume. Binance has stated that it is closely monitoring the situation and is committed to taking necessary actions to protect its user community.

Related: Sony Electronics Singapore Accepts USDC Payments via Crypto.com

A Wave of Warnings in the Crypto Market

The broader crypto ecosystem continues to face a rising number of sophisticated scams, prompting major platforms like Binance, as well as projects like Shiba Inu and Ripple Labs, to issue ongoing alerts to users.

Although the Mantra development team has been accused of controlling up to 90% of OM’s circulating supply, scams in the crypto market remain diverse and increasingly complex.

One of the most common and dangerous methods currently is the use of AI deepfake technology to impersonate influential projects or individuals in the industry. The CEO of Ripple and Charles Hoskinson, founder of Cardano, have both repeatedly warned the community about these risks, urging users to stay vigilant when engaging in the market.