Binance Alpha, the platform dedicated to introducing early-stage cryptocurrency projects within the Binance Wallet ecosystem, has announced plans to list Huma Finance (HUMA) on May 26, 2025. The specific trading time will be announced in detail later.

According to the announcement, eligible users can use Binance Alpha Points to participate in the HUMA airdrop through the Alpha event page, expected to launch on the same day.

About Huma Finance

Huma Finance is a pioneering PayFi network, leading the rapidly growing PayFi ecosystem. This platform enables global payment organizations to conduct transactions 24/7 using stablecoins and on-chain liquidity, providing speed, transparency, and efficiency that surpass traditional financial infrastructure. Backed by strategic partners such as Solana, Circle, Stellar Development Foundation (SDF), Galaxy Digital, and many others, Huma has processed over $3.8 billion in transaction value and delivered attractive real yields for liquidity providers (LPs).

Huma Protocol is implemented in two forms:

- Huma (Permissionless): Launched in April 2025, this version is open to all, allowing individual investors to participate in Huma’s liquidity pools and engage in the PayFi movement.

- Huma Institutional: A service specifically for institutional investors, providing access to credit backed by receivables within a strict legal framework.

Huma Finance has successfully raised $46.3 million across two funding rounds, with participation from leading investment funds such as Hashkey Ventures, Circle, Distributed Global, and other major names.

Related: Binance Introduces the 19th Project on HODLer Airdrops: Haedal Protocol (HAEDAL)

About the $HUMA Token

$HUMA is the native utility and governance token of the Huma ecosystem, with core roles including:

- Ecosystem governance

- Staking

- Earning rewards

- Transaction currency within the ecosystem

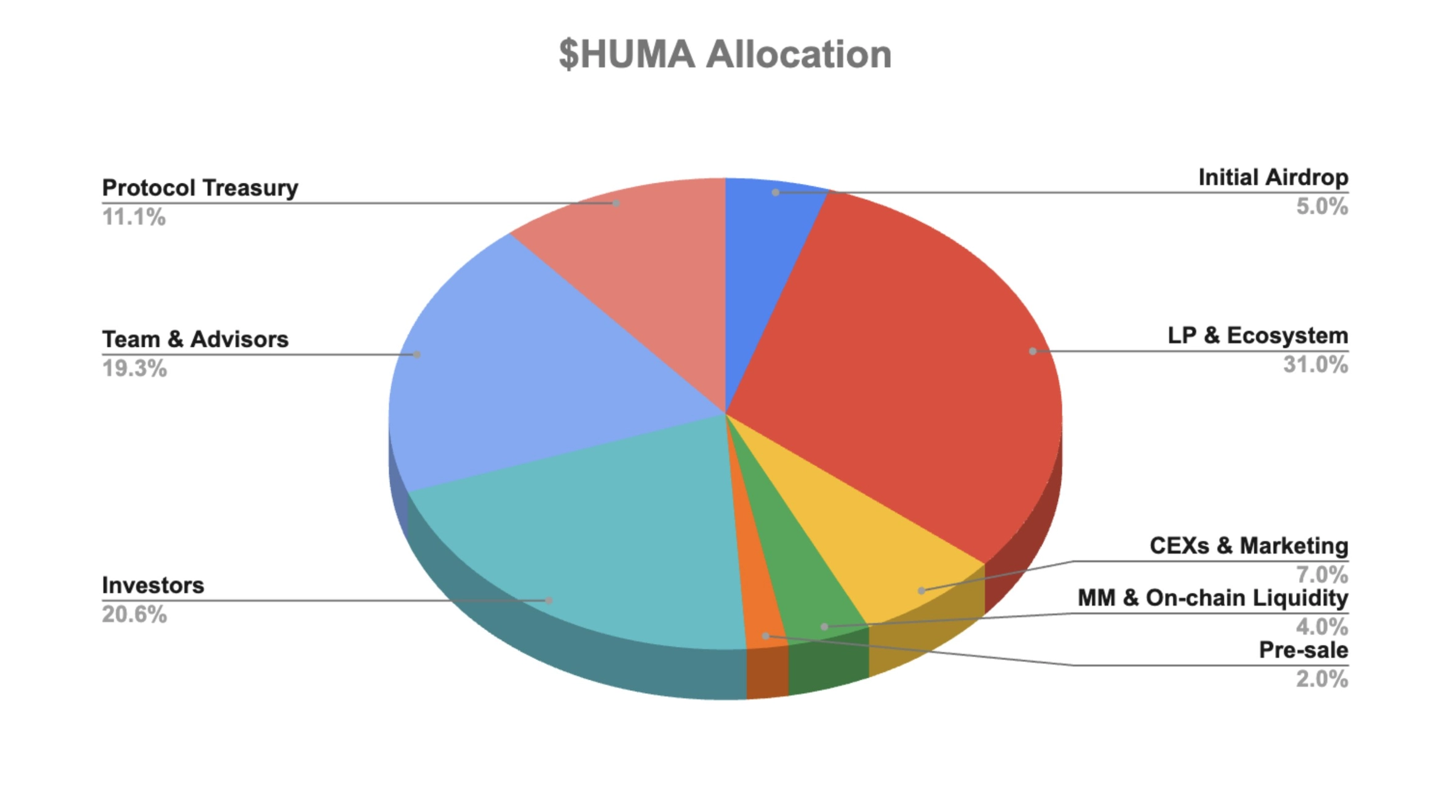

The total supply of $HUMA is 10 billion tokens, with 17.33% unlocked at the token generation event (TGE), allocated as follows:

- Initial airdrop: 5%

- CEX activities & marketing: 7%

- Market liquidity (MM) & on-chain liquidity: 4%

- Protocol treasury: 1%

- Token swaps with strategic partners: 0.33%