The altcoin market is experiencing a prolonged downturn, leading investors to wonder whether it’s time to give up or patiently wait for a reversal signal. Analyst Michael van de Poppe suggests that altcoins may be nearing a significant turning point, similar to what has occurred before major price surges in history.

The Altcoin Cycle: Distinct and Unpredictable

2025 began with high expectations for altcoins, but instead of breaking out, most of these coins have lost over 80% of their value from their peaks. According to van de Poppe, the current cycle is markedly different from previous phases, making predictions based on old models challenging. He compares the current situation to late 2019 and 2020, when altcoins hit bottom before entering a strong growth phase.

Van de Poppe points out that during the cycles of 2016 and 2019, altcoins typically bottomed out amid global market instability, while gold prices surged. A similar scenario is repeating itself now: gold is maintaining its upward trend, global markets are volatile, and investors are cautious about riskier assets like altcoins.

Related: Bitcoin Trading Volume on Binance Soars, Signaling a New Bull Run

Why Haven’t Altcoins Recovered?

Although Ethereum recently increased by 40% relative to Bitcoin, most altcoins still show no signs of improvement. Van de Poppe believes the main reason lies in the lack of confidence and positive sentiment in the altcoin market. Even a small amount of selling can cause prices to drop significantly, but he also notes signs of quiet accumulation from some investors who are gradually buying at lower prices.

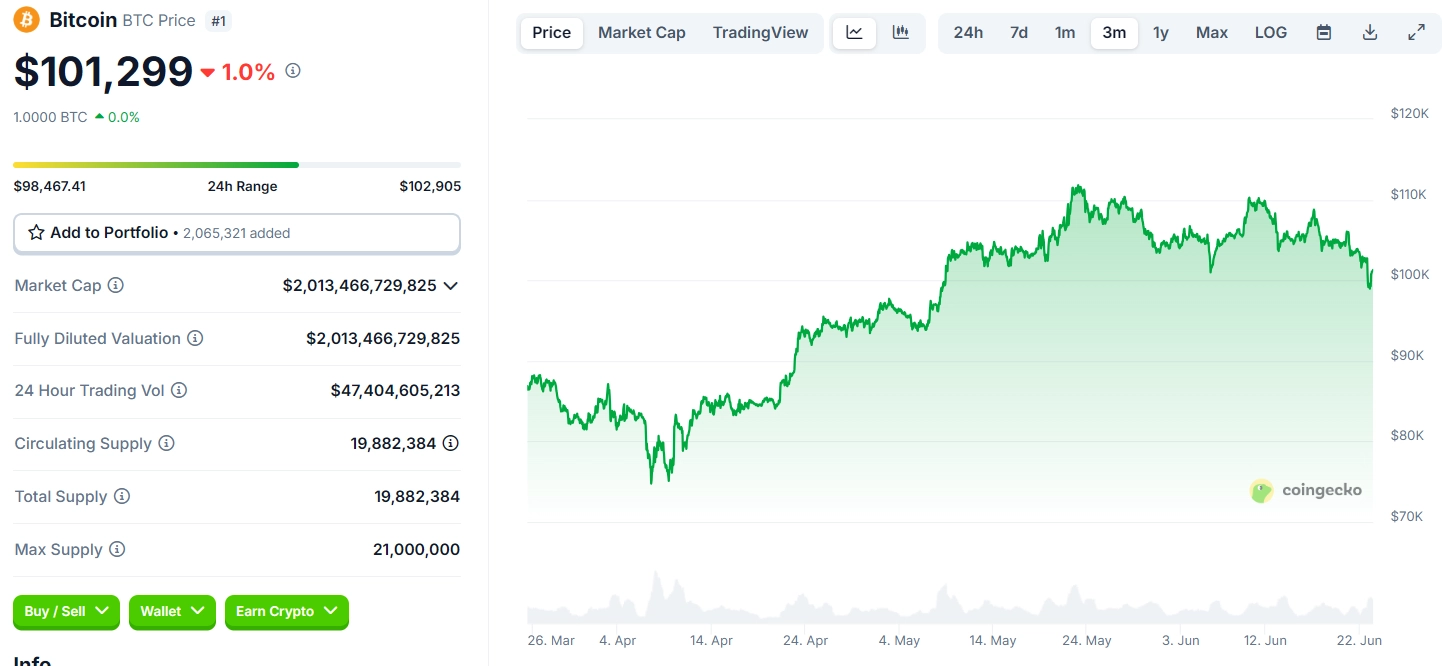

According to van de Poppe, the next moves for altcoins heavily depend on Bitcoin. If Bitcoin hits bottom and rises to around $106,000, this could create momentum for Ethereum to break out again. A second price surge for Ethereum could trigger a strong rally across the altcoin market, leading to the liquidation of short positions and resulting in quick and substantial price increases.