Signs of a New DeFi Cycle

While many rushed to declare that DeFi was “dead” after the market downturn, Aave—the leading decentralized lending protocol on Ethereum—is proving the opposite with its vibrant resurgence.

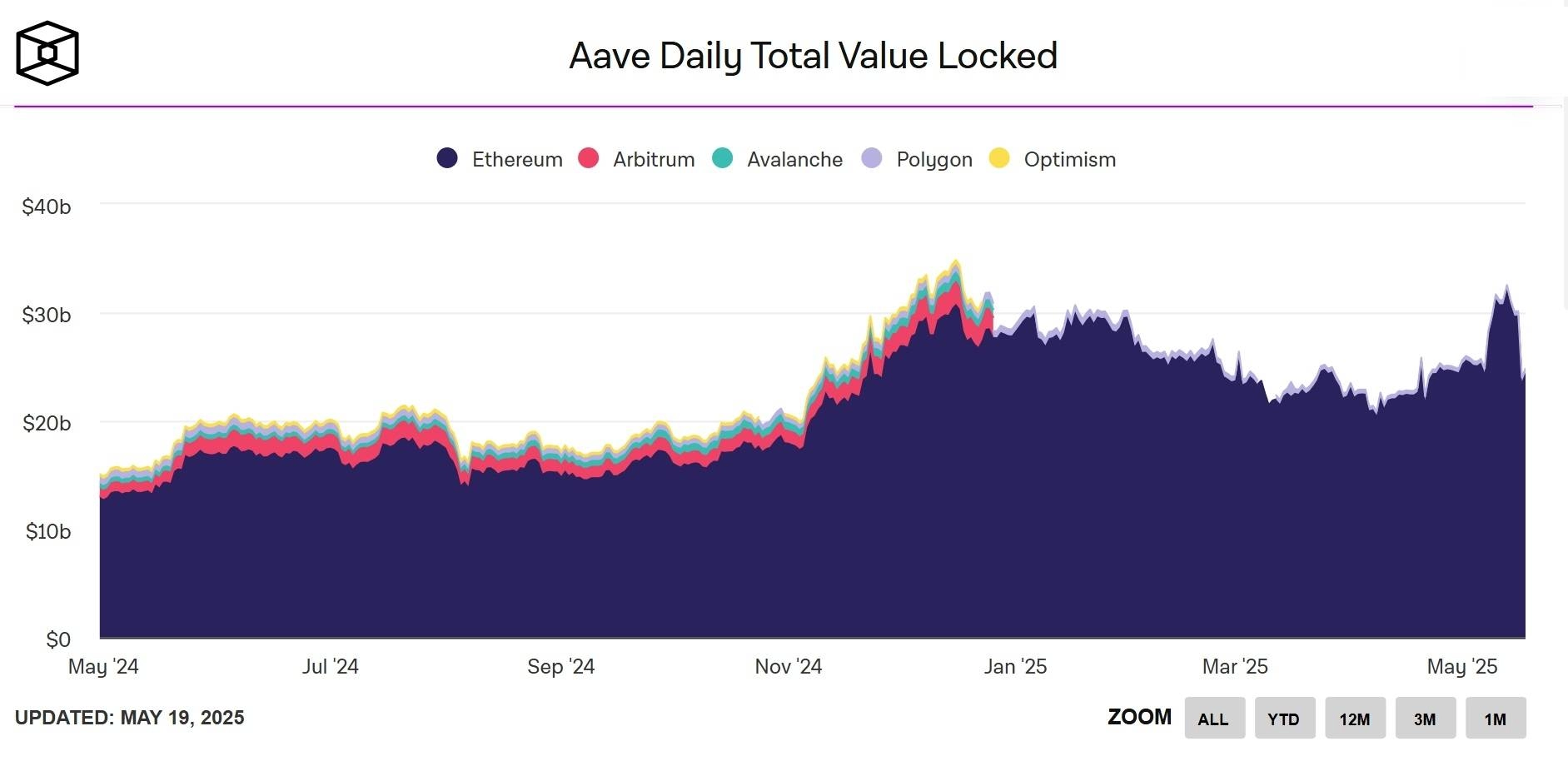

Yesterday, the total value locked (TVL) in Aave officially reached $30 billion, an increase of over 50% from its early-year low, elevating the protocol to the second position in the list of dApps with the highest TVL, trailing only behind Lido. Notably, according to project data, Aave’s TVL peaked at $40.3 billion on May 12, with significant contributions from Aave V3—the latest version of the protocol.

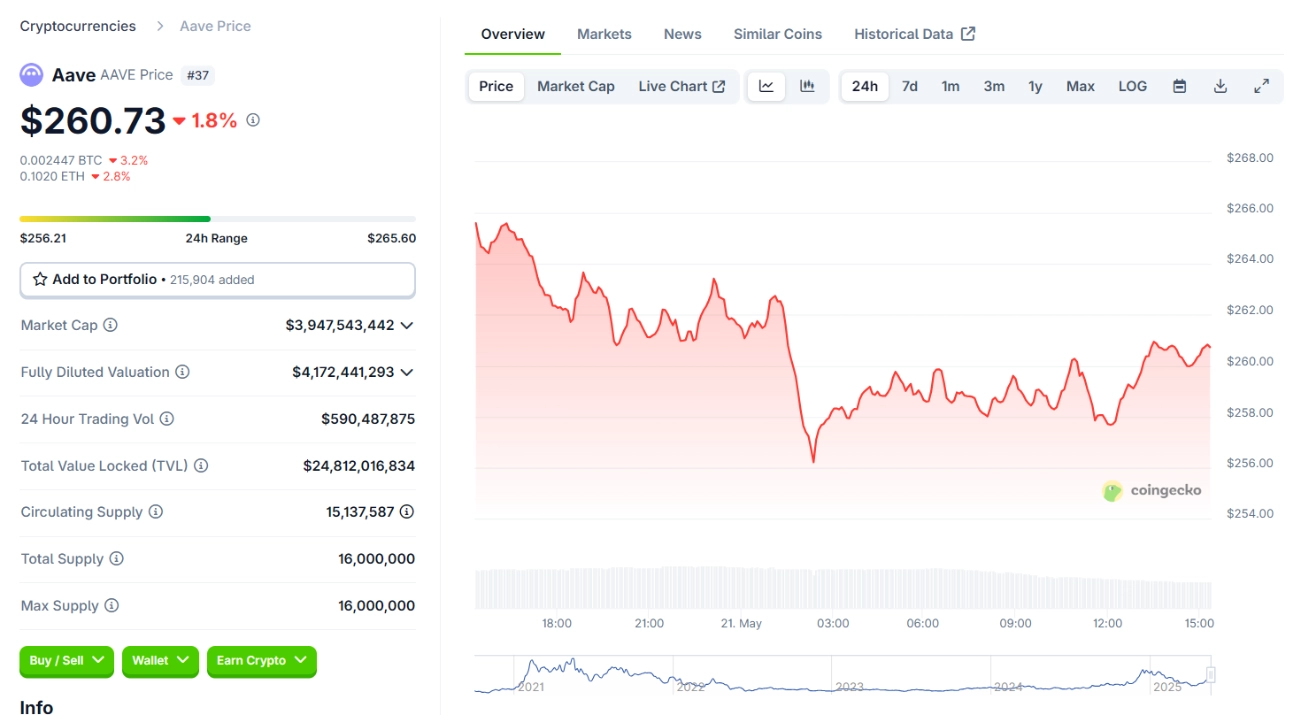

In terms of ETH, Aave’s TVL has impressively grown from around 6 million ETH at the beginning of the year to nearly 10 million ETH at its peak. Meanwhile, the price of ETH surged from the $1,500 range to $2,500 over the past month, with the AAVE token also recording an increase of nearly 25% in just seven days.

Related: Grayscale Launches Aave (AAVE) Investment Trust

Not Just a FOMO Wave

The 50% growth in TVL is not the result of FOMO frenzies or short-term hot money inflows. Instead, it reflects a profound shift in investor sentiment: from a defensive posture to actively seeking sustainable profits. As systemic risks gradually subside and the macroeconomic landscape becomes more stable, idle capital is being reallocated into practical profit-generating strategies, with lending and borrowing serving as the “backbone” of DeFi flows.

Unlike the first wave of DeFi, which relied heavily on airdrops or liquidity mining, the current growth momentum stems from real demand. Currently, Aave reports over $10 billion in outstanding loans, with a debt-to-TVL ratio of 33%—an ideal figure that reflects capital efficiency while ensuring safe liquidity.

Notably, the protocol is generating over $1 million in fees daily, demonstrating deep user interaction rather than merely “depositing and waiting.”

A New DeFi Cycle: Substantial and Sustainable

Unlike the “DeFi summer” characterized by easy money, this cycle is driven by real demand, real users, and long-term capital—factors that were previously scarce in the cryptocurrency market. Aave not only symbolizes the revival of DeFi but also serves as evidence of a sustainable development phase, where true value is prioritized.