At 11:00 AM on April 1, the crypto market suddenly witnessed a sharp decline in several small-cap tokens on Binance, with losses ranging from 20% to 50%. Among the “victims” of this sell-off were ACT, DEXE, KAVA, DF, UFT, HIPPO, LUMIA, HMSTR, and QUICK. Notably, ACT experienced a staggering 60% drop, making it the focal point of the panic wave.

Benson Sun—a well-known expert in the crypto industry and a former partner at FTX—shared an in-depth analysis on social media, revealing the cause behind this price crash. According to him, ACT’s sudden 50% decline at 11:00 AM was not random but rather a direct result of Binance’s own actions, specifically an adjustment to ACT’s leverage position limits. Binance updated its position cap to a maximum of $4.5 million with 1x leverage. Consequently, many market makers who held positions exceeding this threshold were suddenly unable to maintain them, forcing the system to liquidate the excess positions at the prevailing market price.

The collapse of ACT futures created a significant gap between the futures price and the spot price, triggering a domino effect that led to a freefall in spot prices as well. This set off a “flash crash” that few could have predicted.

Related: Crypto Hacks Surpass $1.6 Billion in Q1 2025

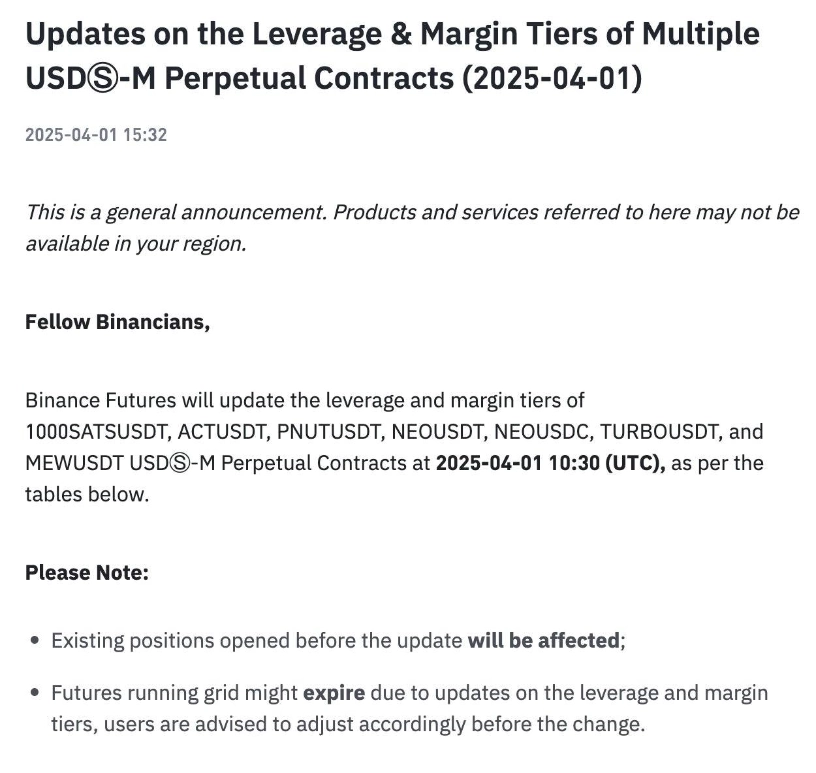

The most controversial aspect of this event was Binance’s extremely short notice period. The exchange officially announced the changes at 8:00 AM on April 1, stating that they would take effect at 11:00 AM the same day—leaving traders with less than three hours to react and adjust their strategies. Although Binance had signaled an upcoming adjustment to ACT’s position limits as early as March 31, the crucial details about the 50% reduction in position limits for low-leverage trades were only disclosed on April 1, catching both investors and market makers off guard.

In his analysis, Benson Sun did not hesitate to criticize Binance’s handling of the situation. He emphasized that before implementing such impactful changes, Binance should have conducted a thorough assessment of the number of positions that could be affected and provided direct notifications to market makers, especially those holding large positions. According to Sun, a transparent and timely notification process would not only give users sufficient time to prepare but also help prevent severe market disruptions like the one that occurred.