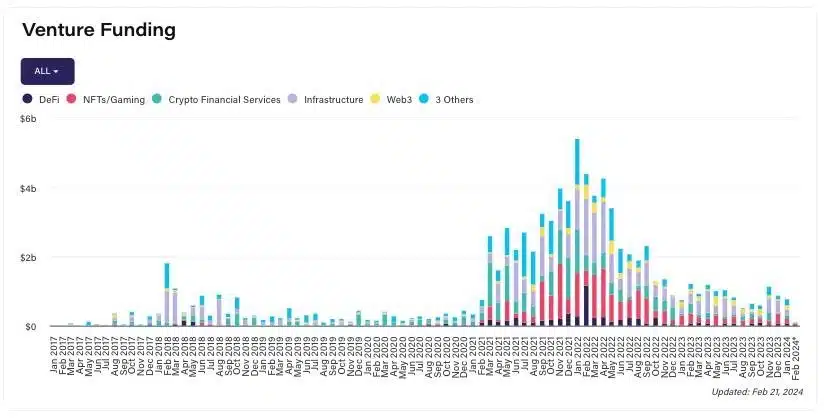

According to statistics from The Block, the total investment poured into the cryptocurrency industry has surpassed the $90 billion mark, thanks to the resurgence of funds from firms in February 2024.

The Block has been tracking investment activities in the cryptocurrency industry since 2017, categorizing them into various sectors including Web3, infrastructure, DeFi, NFTs, gaming, financial services, trading and brokerage, data and analytics, and enterprise investments.

Since the beginning of 2024, the crypto market has witnessed over 230 investment deals with a surface value of $1.3 billion.

Historical fundraising statistics for the cryptocurrency industry. Source: The Block (02/21/2024)

The majority of funds raised in the first two months of investment have been directed towards DeFi, infrastructure, NFT/gaming, and Web3 sectors. Notable funds actively participating in investment include Animoca Brands, Polychain Capital, Framework Ventures, and Shima Capital.

However, The Block points out that despite the increase in the number of investments, the value measured in USD still lags behind the peak period in 2021. The majority of fundraising rounds in recent months have raised less than $10 million. Nevertheless, there have been some notable deals such as EigenLayer ($100 million), Oobit ($25 million), Portal ($34 million).

Related: Bitcoin Battles $51K Resistance Amidst Altcoin Declines

Recent assessment by John Dantoni regarding the cryptocurrency market

The recovery of investment activities in recent months, particularly in seed/pre-seed rounds, the increased risk appetite from Asian-origin funds, coupled with growing interest in DeFi and DePin, indicates that VCs are positioning themselves for a new market cycle.