The cryptocurrency market has long been highly sensitive to global economic shifts, particularly geopolitical events that often strongly influence investor sentiment and asset valuations. Among these, the U.S.-China trade relationship stands out as a key factor, given the immense scale of economic interactions between the two superpowers. Recent positive developments in bilateral trade negotiations have sparked hopes for a far-reaching impact on the crypto market, paving the way for a period of renewed stability and robust growth.

Renewed Investor Confidence

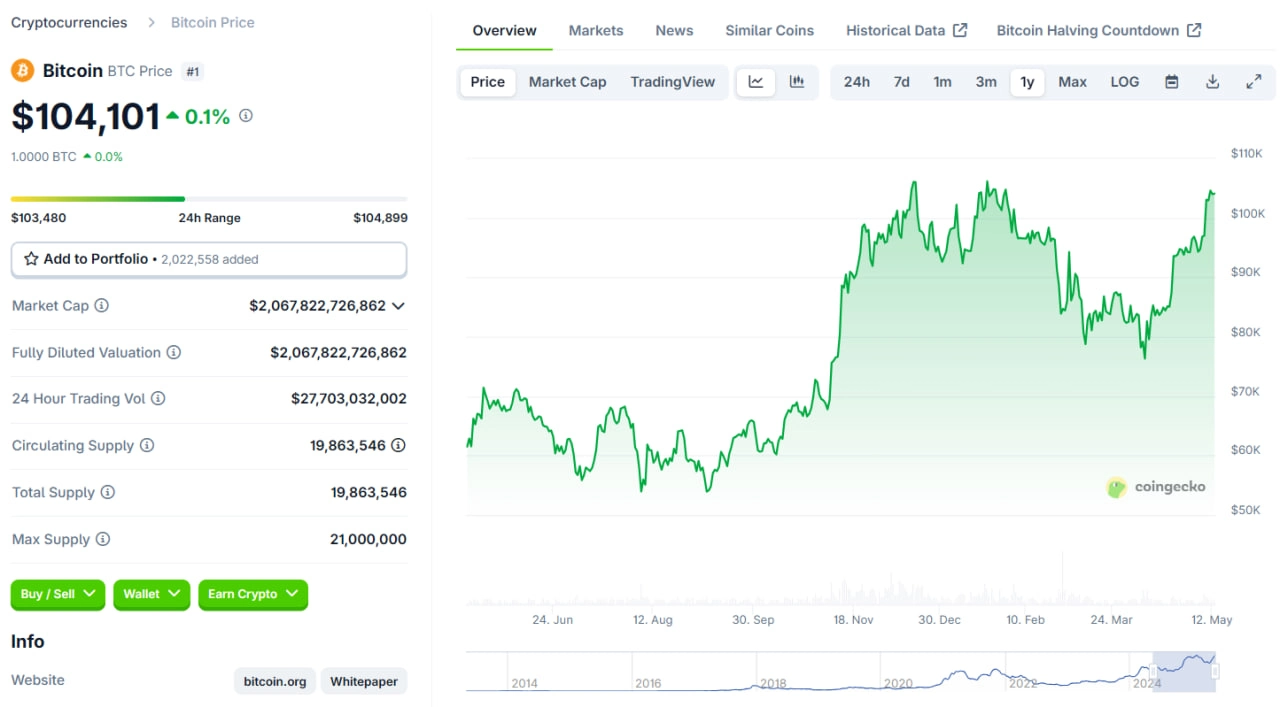

In recent days, optimism surrounding the potential revival of U.S.-China trade talks has coincided with significant movements in the cryptocurrency market. Most notably, Bitcoin surpassed the $100,000 mark, reaching $104,000, buoyed by encouraging signals from both sides regarding tariff reductions and enhanced economic cooperation. This breakout reflects a broader trend: as trade tensions ease, investor confidence rises, driving a strong inflow of capital into risk assets like cryptocurrencies.

Boosting Global Liquidity

A potential trade agreement would not only reduce tariffs but also stimulate economic activity, thereby boosting global liquidity. Historically, ample liquidity has often aligned with upward trends in crypto prices. Analysts predict that under such favorable conditions, Bitcoin could reach $150,000 as early as October.

Attracting Institutional Capital

Diminishing geopolitical risk is making cryptocurrencies more appealing to institutional investors. The anticipation of a U.S.-China trade agreement triggered a 25% surge in Bitcoin trading volume, hitting $18.2 billion within 24 hours of the announcement. The growing influx of institutional capital is providing fresh momentum for digital asset growth.

Toward a Clear Regulatory Framework

Improved U.S.-China relations could also foster collaboration on establishing transparent crypto regulations. Such cooperation would not only enhance the market’s legitimacy but also contribute to greater stability, facilitating broader adoption and deeper integration into the global financial system.

Related:

Conclusion

In summary, an official U.S.-China trade deal holds the potential to become a powerful catalyst for the cryptocurrency market, by restoring investor confidence, enhancing liquidity, attracting institutional investment, and promoting a clearer regulatory framework. The convergence of these factors promises to usher in a new era in which digital assets not only thrive but achieve lasting stability.