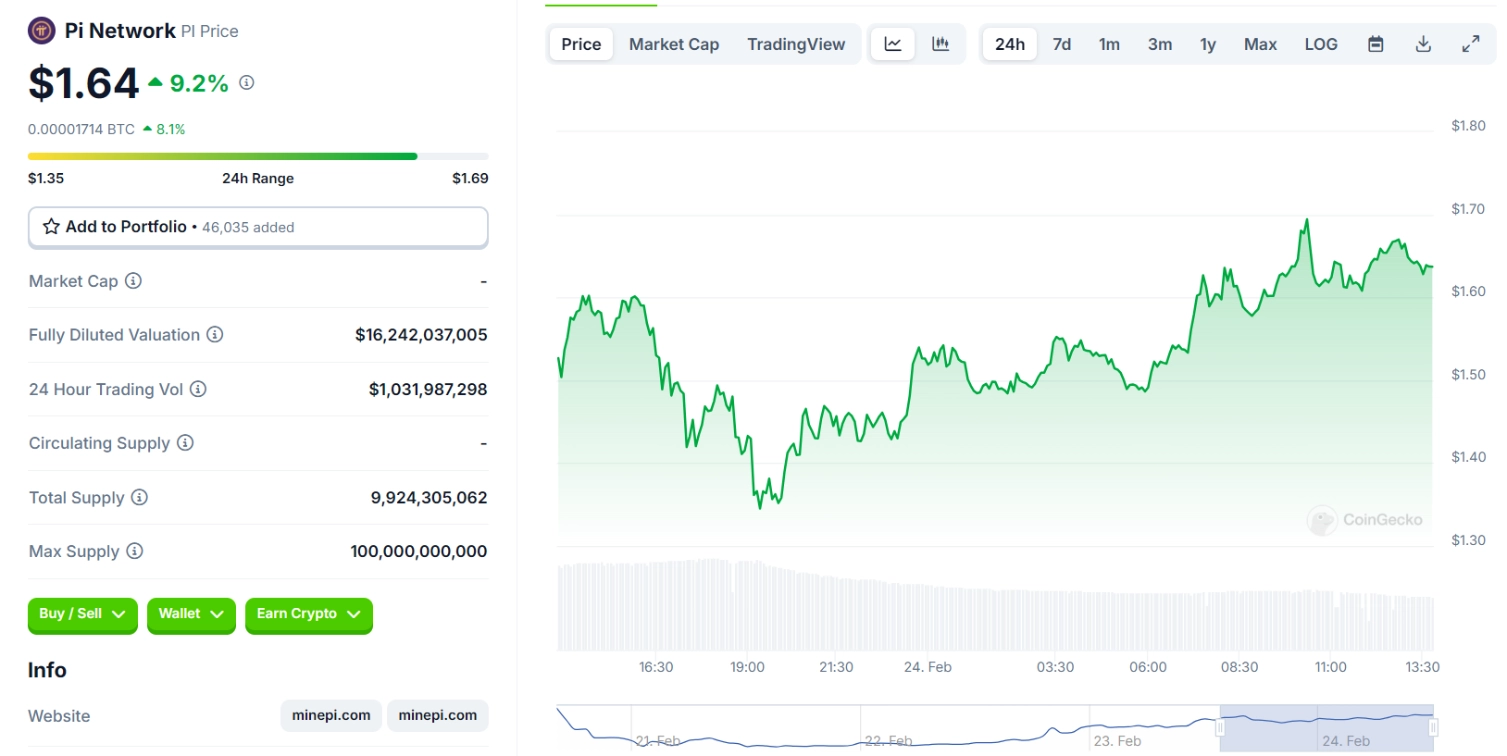

After a sharp decline during its first two days of listing, PI has made an incredible comeback, soaring 150% from its bottom. This remarkable recovery has been fueled by a series of notable events and a wave of renewed optimism within the community. Let’s dive into the key factors behind this breakout.

The Bybit Paradox – When a “Crisis” Becomes a Catalyst

A dramatic twist unfolded when Bybit, the exchange that had previously labeled Pi Network a scam, ironically became the victim of the largest hack in crypto history, losing nearly $1.5 billion. The ripple effect of this incident sparked excitement within the PI community, indirectly contributing to its price surge.

Binance Listing – A Test of Confidence

A survey on PI’s potential listing on Binance has gained unprecedented attention. With 11 million views and over 200,000 votes, 86% in favor, this isn’t just a statistic—it’s a strong vote of confidence in PI’s future on the world’s top exchange.

Additionally, strong buying pressure from investors suggests a high probability of PI being listed on Binance, further boosting optimism.

Related: Who is Nicolas Kokkalis? Who is The Founder of Pi Network?

The Value of Belief – From $2 to $314,159 USD

One of the most intriguing phenomena within the Pi community is the existence of the Global Consensus Value (GCV) at $314,159 USD/PI. Compared to the current price below $2 on exchanges, this massive gap has created a psychological “bargain-hunting” effect, attracting a new wave of investors.

The belief in PI’s potential has driven many to convert faith into action, fueling demand and contributing significantly to the token’s price recovery—creating a positive feedback loop between expectations and real trading activity.

Liquidity Influx & Weakening Selling Pressure

The surge in trading volume not only reflects growing investor confidence but also highlights PI’s increasing market appeal. At the same time, selling pressure from early miners has gradually diminished, allowing new demand to take control.

With long-term holders remaining steadfast, the market outlook is becoming increasingly bullish, laying a strong foundation for PI’s continued price growth in the near future.