0xSifu declared war on the founder of Curve Finance

Specifically, Curve Finance founder Michael Egorov said that “someone” is using CRV to borrow from Silo Finance and short-term this token.

14/ * After my yesterday’s tweet, Mich wrote in the tg group that he came to know that “someone” is using CRV from the Silo for shorting.

He increased utilization to make it very expensive and Sifu repaid a portion of the $CRV. https://t.co/YzuE8Pfg6i

— DeFi Made Here (@DeFi_Made_Here) January 8, 2024

On-chain data shows that this account belongs to “sifu.eth”. Immediately after that, the act of increasing the Utilization ratio (total amount of assets borrowed / total amount of assets loaded) with CRV forced Sifu to quickly reduce its CRV loan due to too high interest rates.

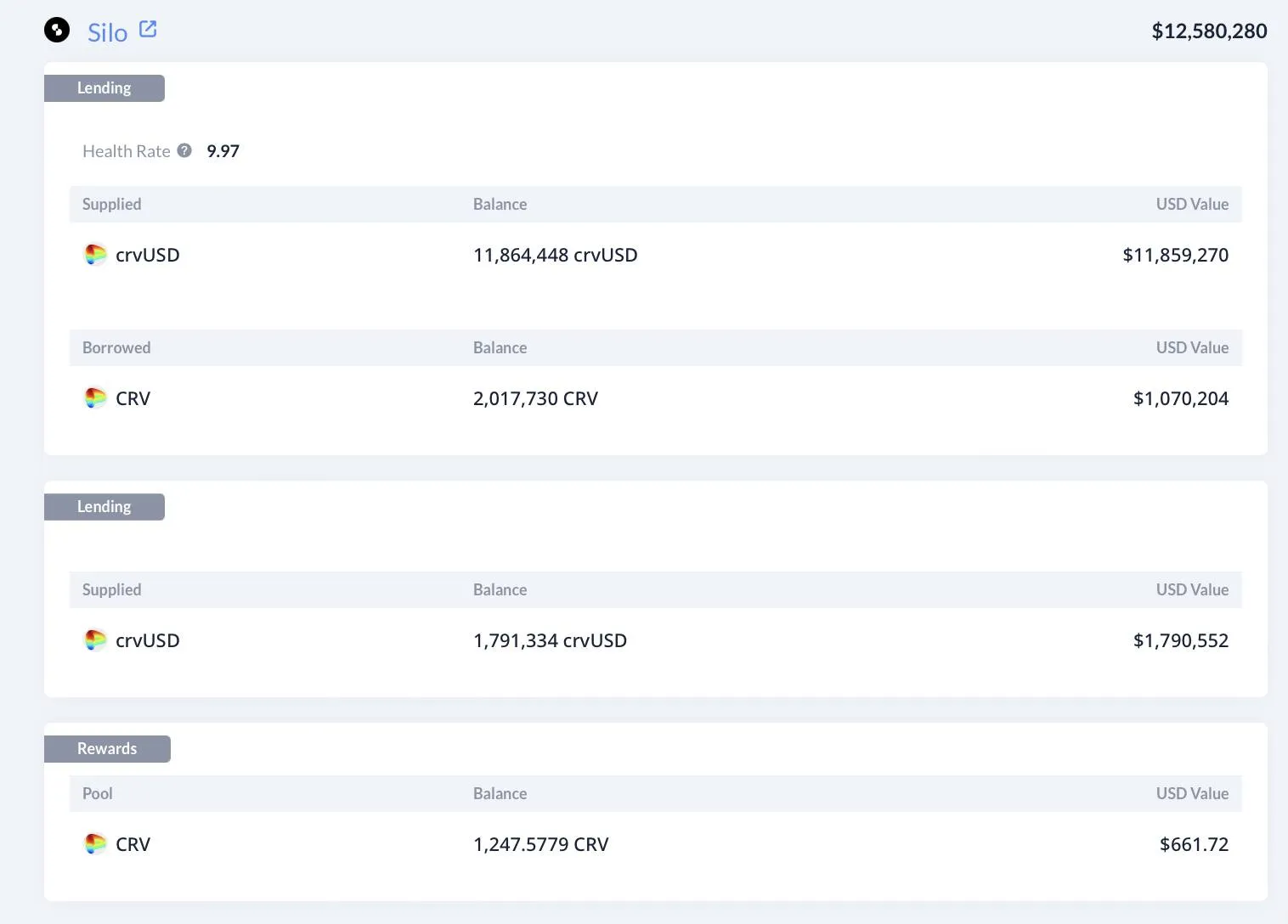

On the contrary, Sifu also counterattacked by depositing crvUSD through Silo, gaining high yield from this stablecoin, as well as a measure to cope with the liquidity shortage. At the same time, Sifu threatened to withdraw stablecoin crvUSD to increase interest costs for Michael.

Currently, according to information, Sifu is mortgaging about 12 million USD in stablecoin crvUSD and has borrowed about 1 million USD worth of CRV.

Sifu’s move is not unfounded, especially after the chain of events mortgaging CRV and borrowing large amounts of stablecoins from the founder of Curve Finance. At that time, this founder’s loan position had become so large that there was “not enough liquidity to liquidate” if the price of CRV decreased.

To reduce his leverage, a series of OTC deals took place in which Mr. Egorov sold CRV tokens at below-market prices, in exchange for liquidity in the form of 92.6 million USDT. This helps the founder of Curve Finance have enough stablecoins to reduce risks in a critical situation.

However, as a habit that is hard to break, Michael Egorov quickly transferred his loans to another platform, Silo Finance, and this is the “battlefield” where Sifu is carrying out his short position.

10/ So Mich borrowed against $CRV again.

This time $75M which are distributed among

Silo: $46.5M (From his and assosiated wallets)

Fraxlend: $15.1M

Others: $13.4M pic.twitter.com/h5ayv6jzzv

— DeFi Made Here (@DeFi_Made_Here) January 8, 2024

Previously, in November 2023, Sifu’s ETH short position attracted the market’s attention. However, the results of this strategy are “not very positive” after Ethereum’s strong rebound.

Related: Curve DAO Agrees to Compensate 42 Million USD CRV

Currently, the community is still buzzing about the outcome of this confrontation, especially when the tacit agreement on the time to unlock CRV tokens in OTC transactions is still a mystery.

azc.news will update the latest developments on this case to inform readers as soon as possible.